Forex and Football: we look at the richest clubs

Do Forex and Football represent a match made in heaven? FinanceFeeds looks at the Deloitte Football Money League and tries to answer.

Announcements about partnerships with football clubs have been made frequently in the online trading industry over the past couple of years.

The recent enactment of the Sapin 2 law in France, however, has turned the attention of the public towards the dark side of such deals, as some of these partnerships have been launched with binary options brands whose reputation is the least to say “suspicious”. It was FinanceFeeds that in September last year lobbied for the termination of the deal between Southampton FC and Banc de Binary. The lobbying was successful. It turned out that French FCs have also rushed to put an end to such deals.

In the meantime, there has been no clarity as to the overall climate in the online trading industry regarding sponsorships of football teams. What happened to FX partnerships with FCs? Are they successful? Do they still continue?

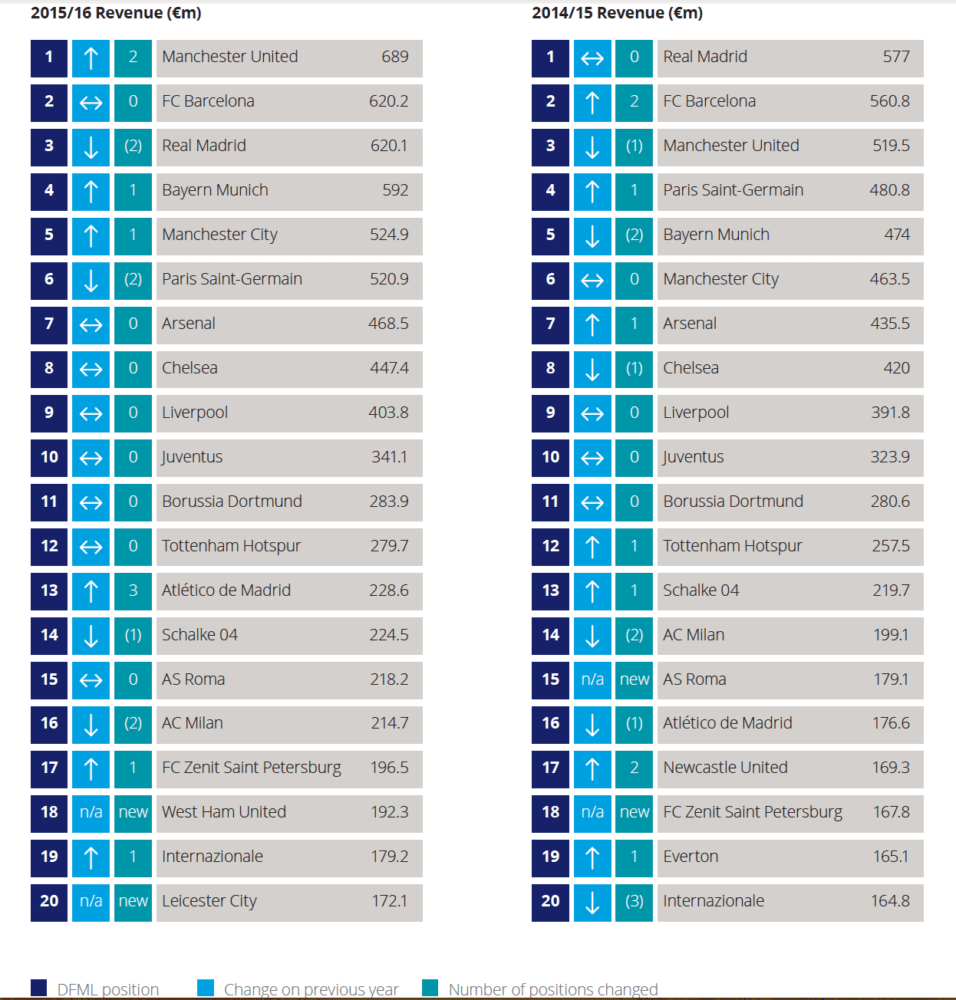

That is why when the 20th edition of the Deloitte Football Money League got published, FinanceFeeds used this as an excuse to examine the fortunes of the highest revenue generating clubs in world football and to check whether these teams have anything to do with electronic trading firms.

The latest edition of the Money League ranks FCs according to the revenues generated during the 2015/16 season. And, yes, Forex firms are present amid the sponsors of the top football clubs.

The top spot goes to Manchester United (€689m of revenues), followed by FC Barcelona (€620.2m) and Real Madrid (€620.1m).

Key remarks

A total of 50% of the football clubs in the top 20 of the Money League currently are or have been until recently involved in a partnership with a Forex company.

- Manchester United – Swissquote sponsorship;

- FC Barcelona – Rakuten Inc sponsorship (back in the days, IronFX was FC Barcelona’s partner);

- Manchester City FC – iTrader.com (back in the days, Manchester City had a deal with Forex.com);

- Arsenal – Markets.com sponsorship;

- Liverpool FC – InstaForex partnership;

- Atletico de Madrid – Plus500 partnership;

- AC Milan – GKFX sponsorship;

- Zenith FC – Alpari sponsorship (extended for the 2015/16 season);

- West Ham United – eToro sponsorship (formerly, Alpari UK was a sponsor);

- Leicester FC – FairFX partnership.

Two football teams (10% of the total) openly admit they are in sponsorship deals with binary options brokers. These clubs are Juventus and Tottenham Hotspur, which have deals with 24option.com and EZTrader.com, respectively.

Two other football teams (10% of the top 20) have gone silent about their deals with binary options brokers – these are AS Roma, which has removed the message about its partnership with EZTrader.com from its website, as well as PSG, whose stance is explicable given the Sapin 2 law.

Six football teams (30% of the top 20) have nothing to do with any online trading companies. One small exception is Chelsea FC, which had a brief flirt (and a bad break-up) with CWM FX back in the days.

Commercial revenues

FC Zenith is the number 1 club in the top 20 with regards to the percentage of revenues it generates from commercial activities – these include sponsorship, merchandising and revenue from other commercial operations. For FC Zenith the percentage is 74%. In this commercial revenues ranking, Paris Saint-Germain and Bayern Munich share the second place, as their commercial revenues account for 58% of their total revenues. The third place in this ranking is for Manchester United (53%).

At the other end of the spectrum is AS Roma, whose sponsorships and other commercial activities generated meager 16% of its revenues. This is not a bad sign for a club’s finances. It means that its business model is focused on generating revenues from other sources – in this case, broadcasting.

How much does a T-shirt cost?

In terms of football sponsorships, paying for the team players’ shirts may demand substantial resources. Numbers from August last year indicate that the average shirt sponsorship costs £11 million per club for the Premier League. For the French Liga 1 the price is £3.5 million.