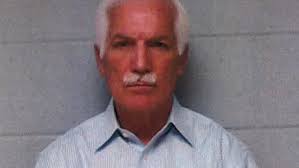

Former Georgia legislator ordered to pay over $10m for financial fraud

The SEC found that Mr. Alford actually used the investor funds to pay personal expenses, including construction costs associated with a multi-million dollar home, and to make interest payments to earlier investors in order to keep the Ponzi scheme running.

Former Georgia state legislator Clarence Dean Alford has been ordered to disgorge ill-gotten gains of $8,849,653 with prejudgment interest of $1,751,085 and to pay a civil penalty of $192,768.

The United States District Court for the Northern District of Georgia imposed restitution, interest, and penalties, based on a complaint filed by the SEC.

The former legislator has also been banned from participating in the issuance, purchase, offer, or sale of any security listed on a national securities exchange, except purchases or sales of securities in personal accounts.

The SEC alleged that from 2017 to 2019, Mr. Alford, who was the CEO, President, and co-managing member of Allied Energy Services, LLC, fraudulently induced at least 100 investors to invest at least $23 million in unregistered, high-yield promissory notes purportedly issued by Allied.

According to the complaint, investors were lied to regarding Allied’s financial condition, who falsely claimed had millions in assets and revenues from 2016 through 2018, even though it had less than $1 million in assets and far less in “gross receipts.”

The former Georgia legislator also falsely told potential investors that Allied would use their funds for various projects, including to support a purported solar energy program, having falsely claimed it established partnerships with several international solar companies.

The SEC found that Mr. Alford actually used the investor funds to pay personal expenses, including construction costs associated with a multi-million dollar home, and to make interest payments to earlier investors in order to keep the Ponzi scheme running.

Yesterday, another court case involving a Ponzi scheme came to an end. Douglas Lien misappropriated client money intended for futures trading and issued false account statements to conceal his fraud, the CFTC found.

The U.S. District Court for the District of New Mexico has ordered Mr. Lien to pay more than $10.3 million in monetary sanctions and relief for a futures trading fraud that lasted nearly 20 years.

the order requires the restitution of $5,195,679 and a civil penalty of $5,195,679. The CFTC warned victims that they might never see their money again.

Mr. Lien admitted that from August 2000 until December 2019, he solicited more than $14.2 million from 45 individuals to manage their trading in commodity futures, specifically U.S. Treasury Bond futures.

Operating a classic Ponzi scheme, he used client money to pay for the false trading profits he declared and kept more than $3.5 million for so-called “management fees”.