France registers drop in complaints about Forex and binaries, but concerns about cryptos grow

Last year, France’s AMF called to order 30 trading platforms – the majority of these are registered in Cyprus.

France’s Financial Markets Authority (AMF) has just published its Annual Report for 2017, marking some positive results of the introduction of the Sapin 2 law which prohibits the digital advertising of risky financial products like binary options and CFDs with high leverage.

The French regulator has been monitoring the distribution of ads of such products in order to make sure that they do not breach the law. The AMF has often recurred to instructing advertisers to take down and/or amend their ads.

In 2017, the regulator called to order 30 trading platforms. Most of them are registered in Cyprus. In the face of the law, illegal ads of toxic trading products were distributed across 140 websites.

Of the 250 ads of online trading products checked by the regulator last year, 161 were illegal and resulted in an action taken by the AMF.

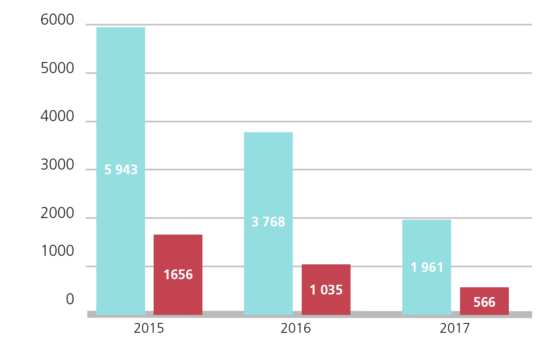

But investors were less tempted to invest in such offers as compared to preceding years. The number of complaints about toxic financial products fell in 2017. There were 566 complaints about binary options and Forex products received by the regulator in 2017, compared to 1,656 in 2015. The drop was 67% when compared to 2015 levels and 48% when compared to 2016 levels.

A new theme that has sparked investor concerns is bitcoin. Following the volatility of Bitcoin’s prices in the fall of 2017, the regulator has noted a rise in the number of enquiries about cryptocurrencies. The regulator says that as the complaints about binary options and Forex, as well as diamond investments drop, those about cryptocurrencies rise.

The data in AMF’s report is in tune with the results published earlier this year by France’s financial ombudsman. The Annual Report for 2017 of the ombudsman shows that the volume of complaints concerning Forex and binary options trading has fallen but concerns about fraudulent practices employed by companies engaged in this sectors remain.

The number of Forex complaints received in 2017 fell by about 50% from the preceding year, the ombudsman says, noting the positive effects of the work of the French financial markets authority AMF and the recently introduced Sapin 2 law. The ombudsman received a total 1,361 submissions (enquiries, complaints, etc) in 2017, down 9% from 2016, and issued 506 opinions, down 5% from 2016 levels.

Forex and binary options trading are among the main reasons for the complaints that the AMF ombudsman received in 2017. However, their number has markedly fell compared to 2016 levels. There were 55 files concerning Forex that the AMF ombudsman investigated in 2017 – this number reflects the cases targeting licensed companies. There were 43 cases that were transferred to prosecutors as the entities in question were not regulated.