France’s black list of fraudulent cryptocurrency entities continues to grow

The French financial markets regulator adds more entries to its blacklist of fraudulent cryptocurrency platforms.

About three months after France’s financial markets authority AMF defined the risks associated with cryptocurrency fraud as material, it has published an updated black list of unauthorized platforms offering trading in various goods, including crypto-assets.

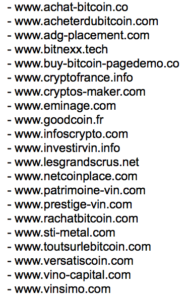

The latest additions comprise 21 names, with the bulk of them being of entities offering activities related to cryptocurrencies – ICOs, trading and mining.

Crypto-currencies and other crypto-assets are not covered by the legal definition of a currency or even, in most cases to date, a financial instrument under French law, which raises the issue of the competence of the various authorities. An in-depth legal analysis conducted by the AMF earlier this year has led to the conclusion that crypto-asset derivatives (regardless of the legal nature of the underlying) could qualify as financial contracts and should therefore be subject to the regulation applicable to the offer of financial instruments in France and in particular to the rules of the Monetary and Financial Code concerning approval, good conduct, and the ban on advertising.

Regarding the legal nature of tokens, the AMF notes that it can be highly variable from one transaction to another. In most cases, they simply give a right to the future use of the service proposed by the entrepreneur, at a preferred rate (utility tokens). The initial valuation of the token during its issue (“primary market”) remains questionable. In some cases, tokens can be traded on a “secondary market” at a price determined by the interaction between supply and demand at a given moment. Investors are thus betting on the project’s success and the future appreciation of the token’s value (if it is actually traded on a “secondary market”).

Like other crypto-assets, tokens generally do not have the characteristics that qualify them as financial instruments in France. However, if a promise of a return is made in the advertising of these offers or if the issuer offers a buy-back option to the investor, the “intermediation in miscellaneous assets” regime must apply, and the advertising documents must be approved by the AMF. Unless they indeed qualify as financial instruments or fall within the intermediation in miscellaneous assets regime (which is rare), ICOs, and other investment transactions on crypto-assets are currently outside the scope of the regulation.