Fraudulent schemes targeting UK investors show rise – KPMG Fraud Barometer

Scotland saw investor fraud triple, leading to losses of £19 million, whereas the value of fraud against financial institutions in Yorkshire has more than trebled in 2016, KPMG research shows.

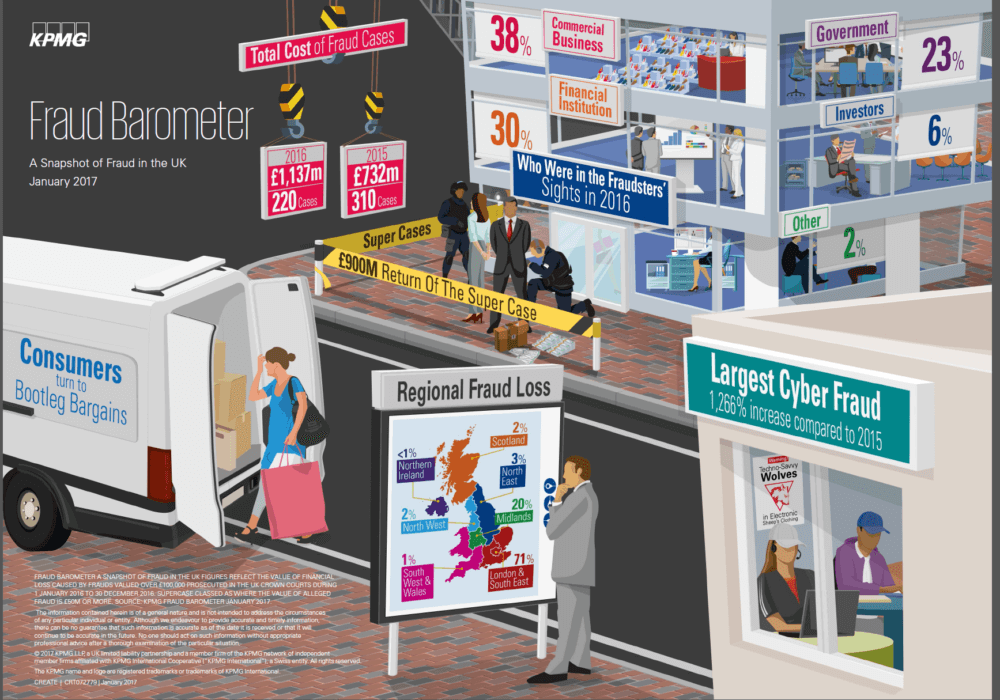

The value of alleged fraud reaching UK Courts passed the £1 billion mark in 2016, according to the latest KPMG Fraud Barometer. The UK suffered approximately £1.14 billion of fraud losses in 2016, up 55% from £732 million in 2015.

The results were attributed to recent economic fortunes.

“As the economy has slowly recovered from the financial crises, businesses and individuals have shown an increased appetite to spend or invest more. That money is now falling into fraudsters’ sights. At the other end of the spectrum, as austerity continues to pinch many, some employees and consumers are adopting less than legitimate means to maintain lifestyles”, says the KPMG report.

Across regions, London and the South East accounted for the bulk of fraud losses. London and South East suffered more than £800 million worth of fraud last year, almost three quarters of all of the UK fraud. Damian Byrne, Forensic Director at KPMG in London and the South East blamed this result on “London’s position as a major financial and business centre”.

Looking at fraud trends in other regions, we see that investor fraud tripled in Scotland, leading to losses of £19 million. It was Scotland that saw 30 shell companies masking the identity of Israeli binary options fraudsters uncovered late last year. This has led the British police to label the binary options industry as the UK’s biggest ever Internet scam. The bulk of the industry operates from Israel but is regulated in Cyprus, which allows companies to offer their services across Europe while avoiding the regulatory grip of domestic watchdogs.

The average fraud claim against binary companies in Britain exceeds £20,000.

Back to the KPMG Fraud Barometer, the key findings for the North East show that investors have experienced the most substantial rise in fraud value, with £10 million worth of fraud committed against them in 2016, against £2.9 million in 2015.

In Yorkshire, high-value fraudulent activity targeting investors accounted for 61% ,or £11.7 million, of the total value of all fraud in the region. The value of fraud against financial institutions in the region has more than trebled in 2016, to £2.1 million.

The North West also displayed a worrisome picture for investor-related frauds, as the value of such fraudulent schemes against investors staging a jump of 89% during the year to £3.6 million. Graham Cochran, Forensic Director at KPMG in the North West, confirmed that bogus investment schemes continue to catch people out and often target the vulnerable in the UK society.

In the South West and Wales, investors and financial institutions were the main victims of fraud, accounting for 75% of fraud by value in the region.

The findings of the KPMG Fraud Barometer are in tune with the results displayed by the latest Crime Survey for England and Wales (CSEW), which showed that fraud was the prevailing type of crime in the year to September 2016. During that period, there were 3.6 million fraud and 2 million computer misuse offences.