French traders mobilize against FXCM

French traders are exploring options to claim compensations for any losses suffered during the period during which FXCM traded against its clients.

Following US regulatory findings that FXCM (NASDAQ:FXCM) had traded against its clients for years, the pile of questions regarding whether this has also happened overseas is growing. Moreover, in the face of the broker’s claims that the disposal of its US retail FX business will in fact propel the profitability of its non-US business, uncertainty has been mounting as to what in fact is happening at FXCM UK, FXCM France, FXCM Australia…

FinanceFeeds reported that Drew Niv’s director appointment at FXCM UK was terminated on February 9, 2017. This is pretty much all we know at this point about the aftermath for overseas FXCM companies.

There is nothing astonishing then that clients of FXCM in France are trying to take pre-emptive measures and prepare for the worst.

The centre of this movement is ATPF (Association des Traders Particuliers Francophones), an organization that seeks to protect the interests of retail online traders in France. The organization’s president Pierre Georges is known for his harsh stance against binary options and misleading advertising, as well as for his conflicts with some brokers.

He is now calling for clients of FXCM France to unite and commence the necessary procedures (including legal ones) against the broker. What ATPF is trying to prove is fraud against clients of the company during the period during which (according to the US regulators) FXCM US traded against its clients. The French traders assume that the same fraudulent actions were committed against them and that this may result in a claim for compensations for any losses incurred during the years (2009-2015) when FXCM had falsely alleged to be using a non-dealing desk model.

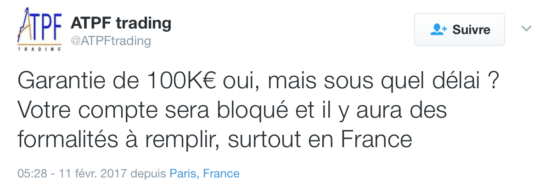

Furthermore, the French traders are concerned that in case FXCM’s overseas business folds, they will face – and that is the best case scenario, the clumsy procedures of seeking compensations from the Financial Services Compensation Scheme (FSCS) in the UK. Given the heavy bureaucratic burden in France and eventual accounts freezing, the road to getting one’s money back looks endless.

Mr Georges recommends the services of PAG Avocats, who have represented the Association back in January 2015, with regards to negative balances incurred as a result of “Black Thursday” events. In October 2015, the Paris prosecutor’s office transferred a complaint by the ATPF against FXCM to the financial police for investigation.

The story is complex (and quite ugly) given that FXCM has threatened to sue Pierre Georges for defamation. The status of the Association and Mr Georges have been questioned too. There are also comments on social networks about the uselessness of his actions, as these are like “shooting at an ambulance”.

Nevertheless, it is worth noting that Mr Georges is only proposing traders to unite and take pre-emptive action. Not to mention that it takes some guts to oppose a large financial company.

ATPF promises updates on the legal procedures for clients of FXCM France this Thursday.

Another organization that has addressed French clients of FXCM is Warning Trading. It has called everybody using the services of this broker to contact Warning Trading, in order to organize possible counter-actions.