FSCS mentions Alpari (UK) only once in annual report for 2016/17

Whereas in 2015/16, the insolvency of Alpari (UK) was one of the key topics for FSCS, the now defunct broker is mentioned only once in the FSCS Annual Report for 2016/17, with regard to legacy issues.

The importance of January 15, 2015 events and their consequences for the Forex industry is apparently starting to fade for authoritative bodies, as the name of Alpari (UK) – the retail FX broker that went insolvent as a result of these events, is mentioned only once in the Annual Report for 2016/17 by the UK Financial Services Compensation Scheme (FSCS).

The name of the now defunct broker which is currently under administration is mentioned in a part of the text entitled “Legacy of 2008”. The text goes as follows:

“FSCS continues to work hard to maximise recoveries from the estates of failed firms and from third parties responsible for customers’ losses. Since the 2008/09 banking crisis, we have recovered £4.5bn from the estates of the failed Icelandic banks, London Scottish Bank, Keydata Investment Services, MF Global and Alpari (UK) Limited.”

There is not even a single mention about LQD Markets (UK), which also went insolvent following the “Black Swan” events of January 2015.

By contrast, in its report for 2015/16, the Scheme stressed the amount of compensation paid to clients of Alpari (UK) and LQD Markets (UK) and said that “these defaults highlight the need for FSCS to respond to sudden and unexpected firm failures quickly, returning client funds to customers through a streamlined payments process.”

The FSCS notes in its 2016/17 report that no investment intermediation firms have been placed into the Special Administration Regime this year, in contrast to the large numbers of claims in this segment in recent years.

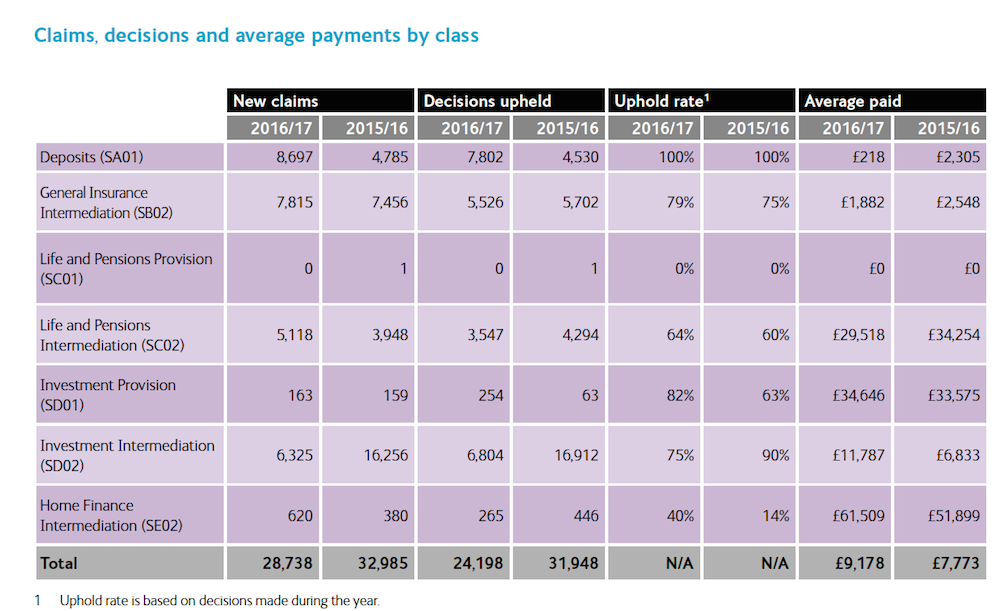

As the table below illustrates, the number of new claims concerning investment intermediation firms fell to 6,325 in the year to March 31, 2017, compared to 16,256 in the year to March 31, 2016.

Across all financial services firms, during the year, total compensation payments made by FSCS were £351 million, up from £271 million in 2015/16. The rise in compensation payments is attributed to a big increase in general insurance claims resulting from the failures of Enterprise and Gable Insurance AG (Gable).

In June this year, the joint special administrators (JSAs) of Alpari (UK) published a notice on the final client money distribution. The amount of the final client money distribution was put at 27 cents in the $ (USD). This is set to take total client money distributions to 82 cents in the $.

According to the JSA’s 4th Progress Report, covering their work on the case from July 19, 2016 to January 18, 2017, to date, 94,375 clients got access to the Claims Portal, whereas 16,278 clients have agreed their claim representing 96.2% by value of clients with a claim into the Client Money Pool (CMP). The report said the JSAs have paid a total of about $51.8 million from the CMP to 12,503 clients, representing approximately 53% of the CMP. The administrators forecast back then that total claims into the CMP will reach $97.8 million.