FTSE 100 makes massive dive to two year low. US sell off is not the reason

Brexit related wranglings and potential exits from the Eurozone by struggling economies in the mainland may be the cause of FTSE 100 downturns. If this is prolonged, multi-asset traders may flock into brokerages

During the past 24 hours, the FTSE 100 index which is the share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation, has taken its largest dive since August 2016, resulting in many City analysts across London taking the superficial opinion that this has been caused in part by a move by US Federal Reserve chairman Jerome Powell who hiked rates to a range of 2.25-2.5 per cent – the highest level in a decade, despite vocal opposition from US President Donald Trump.

Whilst transatlantic financial activity may well contribute to fluctuations in the value of highly capitalized companies on the British market, there most certainly is more to this than meets the eye.

All three major US indices fell as a result and Asian markets followed last night, with Japan’s Nikkei down 2.8% and Hong Kong’s Hang Seng Index dropped by 1% however these markets are very sensitive to movements in stock prices of British firms because large public companies in the UK often have a large amount of reliance on Asia Pacific markets, and traders in the Asia Pacific region are very much connected to UK equities and indices in the trading of their portfolios.

The FTSE 100’s fall has been 18% in the last 24 hours, which is dramatic and is more likely to be connected to the need for British firms to address their shareholders with regard to Brexit-related structuring in the event of no trade deal with Europe.

In addition, the Eurozone’s member states have demonstrated a lack of confidence not at the polling booth, but at the banks as Italy, one of the southern European states with a desolate national economy, could be at the forefront of a bank run on the Euro.

As mentioned by FinanceFeeds earlier this week, the Italian government is defying the European Commission’s request that it revise its draft budget for 2019 to reduce the deficit. Bond yield spreads are widening and Italian banks are under pressure. Should a bank run ensue, some British economists are looking at the possibility that this could be one catalyst that could end the monetary union.

This possibility could result in a divestment by large firms from Europe altogether for fear of capital control laws applying on a continental basis, and if Italy wants to impose national capital control laws, it would have to exit from the Euro altogether.

European markets have felt the force of the global selloff with the FTSE 100 down 1.05%, dropping below 6,700 points to its lowest level since August 2016 and the blue chip index had dropped as much as 1.7 per cent in early trading before recovering ground but the FTSE 100’s downturn is the highest showing that traders are taking a conservative view across British markets which are the mainstay of the financial sector for all of Europe.

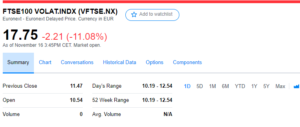

Looking at the FTSE 100 volatility index, there has been a considerable downturn in volatility over the past few days, which should not be viewed as a lack of confidence in British stock but more a considerate, low risk view by stock traders who are waiting for further Brexit wranglings to end, or to see if European markets become adversely volatile if the bank runs that have been alluded to earlier this week in Italy actually proceed.

Effectively, asset classes that pertain to companies that have a read-across with Singapore, Hong Kong, Australia and Japan are buoyant and those with significant contributions of revenue being earned and taxes remitted to Europe are down.

This pattern in itself shows that a lack of volatility in stock and equity markets may last until the Brexit takes place in the Spring of 2019.

Meanwhile, FX brokerages are able to make good of the possibilities and increase their client base of multi-asset traders.