FX and CFD brokers must go multi asset: Join free webinar from TraderEvolution to learn how

For the past 30 years, the online trading industry has been through many transformative stages – driven by technology, regulation, and overall market dynamics – only to come out stronger and ready for this day and age.

And now we’ve reached a point in time in which all assets must be accessible for trading. That’s what customers want and that’s what they will get.

For your brokerage to be on that list of eligible trading services providers, there is no other choice but to adapt to the times and go multi-asset. We mean truly multi asset because CFDs alone won’t cut it.

If you analyze the trading industry in the past decade you would notice that the Main Street’s attention was shifting to a different asset class every few years.

2010-2015 was the heyday of the FX and then CFDs industry, 2015-2018 was an era of cryptocurrencies and 2019-2021 stocks and ETFs had their great comeback.

Such a situation was quite troublesome for almost every single asset class broker out there, and most robust names transitioned to a true multi-asset model fairly quickly, gaining unbelievable advantage.

Era of multi-asset trading at brokerages

The complexities for brokers going “all asset” undoubtedly increase, namely via market data and its licensing policies, but there are ways to automate and handle the challenge.

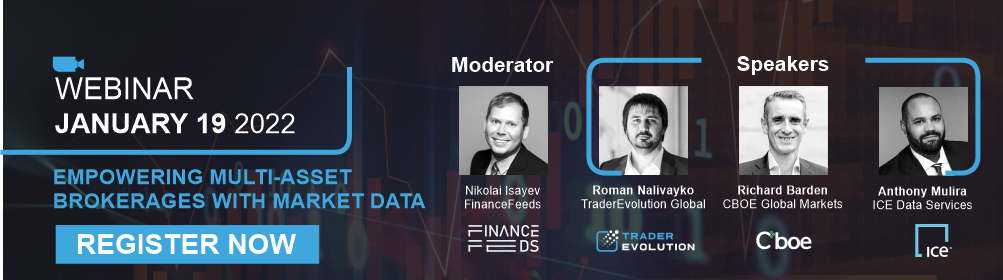

TraderEvolution Global is hosting a free webinar to address this issue along with prominent industry veterans Richard Barden from CBOE, and Anthony Mulira from ICE.

The role of a platform vendor, in principle, is to implement solutions based on requirements. In the case of market data it’s no different, just the requirements come from market data licensing agreements and brokers need solutions that make their life easier.

A little bit of creative approach results in more and more ideas on small, evolutionary, improvements which sum up into an overall optimization, so significant when more assets and market data streams are being added.

Brokers have entered an era of all-asset accounts, and that is especially true for regional brokers in different parts of the world.

Regional brokers not only compete with their local peers, but they are now seeing competition from top worldwide names such as InteractiveBrokers, SaxoBank, Exante or Etoro.

We have entered a time when going for shortcuts is not working anymore. Many FX brokers, for example, introduced CFDs from most popular markets in order to face growing and more expansionary multi-asset competition. Today however more and more brokers offer real equities, futures and options even on top of their regular CFD offering and that is a much more viable tactic to win serious investors as clients.

“In one of the use cases, with our product we help regional brokers to compete with the big names that provide an extremely wide coverage of markets. Market data is a big part for such projects, we cannot do much about market data license policies, but we can make processes of handling market data more automated, cost effective and more easygoing for brokers and end users.”, said Roman Nalyvaiko.

Big discussion on market data for brokers

TraderEvolution Global, the webinar host, is a multi-market trading platform provider offering modular, tailored solutions that include a back-end with established connectivities to dozens of markets across the globe, and a complex front-end suite with web, mobile, and desktop applications.

The unique panel features Roman Nalivayko from TraderEvolution Global, Richard Barden from CBOE, and Anthony Mulira from ICE. FinanceFeeds Editor in Chief, Nikolai Isayev, will moderate the webinar.

Richard Barden is Director, Market Data Sales at Cboe Global Markets. He is responsible for the expansion and distribution of Cboe’s Market Data offerings throughout Europe and the Middle East. In speaking about Cboe’s market data offering, Richard commented: “Cboe is one of the world’s largest exchange operators, offering data from four asset classes (equities, options, futures, FX) across 22 countries. We work with brokers to determine the right market data solutions for their businesses, so they can scale efficiently. Our reliable data solutions are available through direct feeds, vendors and via the cloud. Cboe has worked with many retail brokers across the globe, and we make licensing our global data easy and cost effective.”

Anthony Mulira is the Director of Global Pre-Sales, Real Time Feeds at ICE Data Services, the subsidiary of Intercontinental Exchange that offers some of the most regarded market data solutions for brokers, including ICE Consolidated Feed, ICE Global Network, and Blockstream.

ICE Consolidated Feed is a dynamic and customizable solution that allows customers to access hundreds of sources of data through one simple interface, covering more than 25 million instruments.

ICE Global Network allows brokers to access high-quality data feeds through a secure network and reduce their technical footprint. “Our customers can host or collocate their equipment in key trading centers in our global datacenters, and all large cloud providers”, said ICE’s Mulira.

Blockstream is ICE Data Services’ product designed for digital assets as brokers increasingly flock toward the emerging asset class.

In regards to Blockstream, Anthony commented: “The cryptocurrency data feed is part of ICE’s relationship with Blockstream and delivers best-in-class, real-time and historical trade data from the world’s leading and most actively traded cryptocurrency venues in a fully licensed manner. We work with our customers to provide the data they need to make more informed decisions about cryptocurrencies, including value add statistics such as regional closes, daily volume, turnover, trade count, VWAP, and daily open, high, low and last.”

Many FX and CFD brokers may feel they have reached a crossroads, but there is no turning back. Going multi-asset is the only choice available for those who want to stay in the game.

Sign up for the exclusive webinar