FXCM shifts focus to FXCM UK, clarifies stance regarding US residents

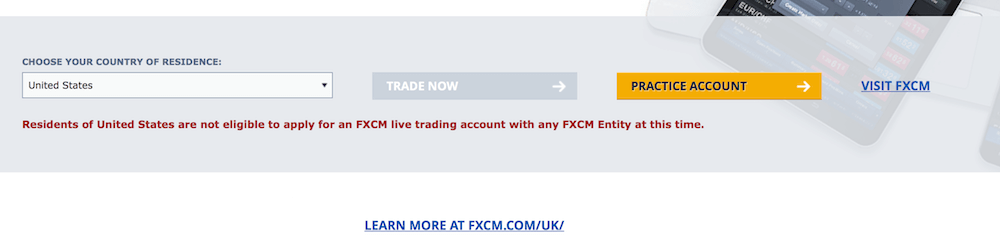

FXCM.com, which used to provide link to FXCM Markets to US residents, now offers a link to FXCM UK for more information.

Earlier this month, FinanceFeeds unearthed a topic about FXCM that seems to have been set aside for several years – the fortunes of its FXCM Markets subsidiary. As the United States National Futures Association (NFA) implemented the bar on Forex Capital Markets LLC (FXCM US), the website FXCM.com has turned into a sort of a landing page and initially provided a link to FXCM Markets for residents of certain countries, including the United States, Singapore, Hong Kong and Russia.

This has changed and currently FXCM.com offers US residents to visit FXCM UK’s website for more information about the broker.

This change may be interpreted in several ways: first off, we are talking about the company shifting its focus to its UK business. This is somewhat expected, as FXCM UK’s head Brendan Callan became the (interim) CEO of FXCM Group. Moreover, FXCM has kept insisting that what happened to FXCM US will not affect the non-US companies of the Group. Even more importantly, there has been no action against FXCM UK thus far from any regulators.

Another aspect to consider is that the link to FXCM Markets could have been seen as misleading. FXCM Markets is Bermuda-based unregulated entity and it does not target clients from the US, Japan, Hong Kong, the European Union and Australia. Targeting of US residents by a Forex entity based outside of the US is illegal.

This may be one of the reasons why FXCM has made its warning towards US residents more precise. It now says that: “Residents of the United States are not eligible to apply for an FXCM live trading account with any FXCM Entity at this time”.

This compares with a previous warning that omitted the part “with any FXCM Entity”.

The disclaimer applies not only to residents of the United States but also to residents of Hong Kong, New Zealand, the Russian Federation, Singapore, Virgin Islands (US), and American Samoa (list is not exhaustive).

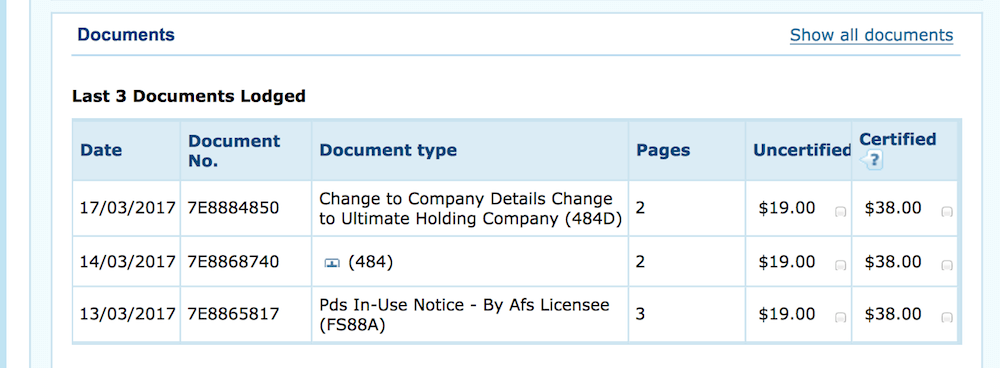

While we are on the topic of non-US FXCM entities, let’s mention a little something about FXCM Australia. On Friday, March 17, 2017, the company filed report 484D with the Australian Securities and Investments Commission (ASIC). Although the content of the report is not publicly available, the designation says “Change to company details, change to ultimate holding company”.

Nevertheless, ASIC’s database still shows that Forex Capital Markets LLC, the entity slammed by US regulators, is still an Authorised Australian Financial Services Representative of FXCM Australia. There has been no change in this respect since FinanceFeeds’ previous report on the topic.