FXCM slashes spreads on EUR/USD (43%), AUD/USD (54%), more

“In recent months, big swings in global currencies such as the euro’s decline against the dollar have created opportunities for retail investors, driving many towards the FX market.”

FXCM Group has reduced its spreads by as much as 54% on major currency pairs and indices, available for clients under Forex Capital Markets Limited, FXCM EU LTD, and FXCM Australia Pty. Limited.

The above changes currently apply to TS2 accounts. FXCM intends to apply similar changes to MT4 accounts in the future. MT4 is a 3rd party platform and therefore there are additional technical challenges when it comes to making pricing changes.

The FX and CFD broker took to opportunity to remind customers and potential clients that FXCM continues to deliver quality execution with 84% of all orders receiving positive slippage or zero slippage.

The data comes from various order types that executed through FXCM Group from 1 January, 2022 to 30 June, 2022. Data excludes certain types of non-direct clients, e.g. clients of certain intermediaries.

High execution rates mean that FXCM tends to successfully execute the trades placed by clients at the expected prices or even better.

FXCM drops spreads in EUR/USD (43%), AUD/USD (54%), US Oil (30%)

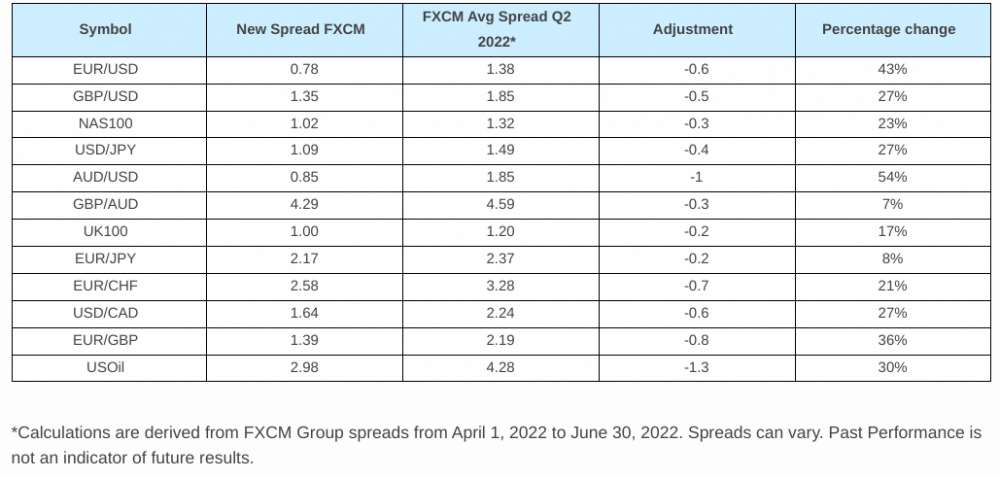

FXCM’s new, improved, spread offering point to a 43% drop for the EUR/USD, the most traded pair in the FX market. The highest drop in spreads, however, is the AUD/USD (54%). The broker also added a notable drop in the spread of US Oil (30%).

The new spreads, available on desktop, mobile, and web trader platforms, are detailed below:

Brendan Callan, CEO of FXCM, said: “In recent months, big swings in global currencies such as the euro’s decline against the dollar have created opportunities for retail investors, driving many towards the FX market. In line with our ‘Client First, Trader Driven’ mantra, we have made our pricing more competitive than ever before and are committed to continue offering quality execution and the best possible experience for our clients.”

FXCM, recently named Broker of the Year at the Ultimate Fintech Awards, has continually expanded its services throughout 2022, underlining its commitment to a “Client First, Trader Driven” approach. In addition to expanding its CFD offering with the doubling of its French, German and UK share offerings, the firm also launched Australian single share CFD trading with zero data fees and commissions3 to enhance the service provided to clients.

When executing customers’ trades, FXCM can be compensated in several ways, which include, but are not limited to: spreads, charging commissions at the open and close of a trade, and adding a mark-up to rollover, etc. Commission-based pricing is applicable to Active Trader account types.