FXCM UK registers loss of $5m in 2018, pays lavish dividend to FXT

Lower trading volumes impacted earnings of the FX brokerage.

The 2018 financial report by online trading services provider Forex Capital Markets Limited (FXCM UK) has just been made available by the UK Companies House, with the numbers showing a drop in turnover and a widened loss.

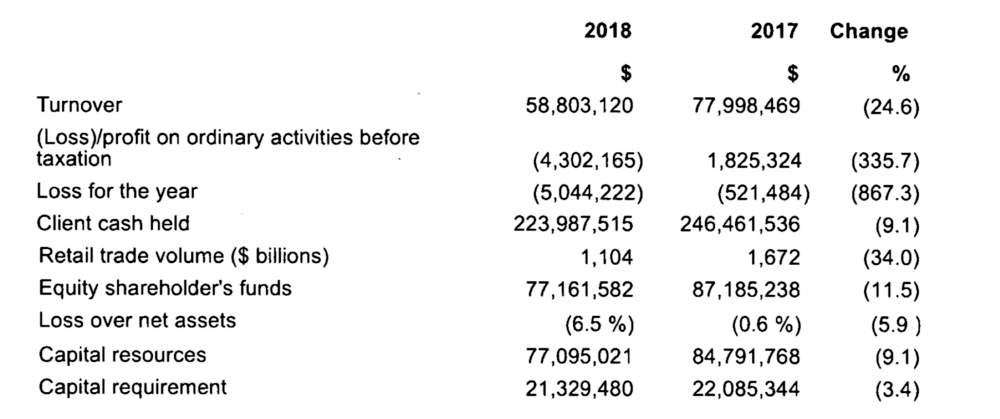

In 2018, the broker saw its turnover shrink by 24.6% year on year to $58.8 million. This, the company explains, reflects a lower FX and CFD trading volume, due to weak currency volatility, and the impact of the ESMA measures which restricted the offering of CFDs to retail clients.

The loss for the year widened to $5.04 million, compared with $521,484 a year earlier.

Client cash held fell 9.1% from the preceding year to $224 million in 2018.

In the face of the dismal results, FXCM UK paid some dividends.

On January 31, 2019, the directors recommended and approved a dividend payment in the amount of $6.5 million to the company’s immediate parent – FXT (Forex Trading LLC), incorporated in Delaware. The dividend amount was subsequently paid to FXCM Group.

In terms of the relations between FXCM UK and FXCM Group LLC, let’s note that, according to the report, at December 31, 2018, FXCM UK had receivable an intercompany loan note from FXCM Group LLC, $5.76 million was the amount of principal and accrued interest due. The loan accrues interest at an annual rate of 4%, an open maturity and can be demanded at any time by the FXCM UK.

Finally, the report states that, across the FXCM Group of companies, a restructuring plan was implemented in March 2019. No details have been provided in this regard.