FXCM UK sees $102m drop in client funds in 2017, sells stake in Salex for €1

FXCM UK remained loss-making in 2017, with retail trade volume and client cash down.

Forex Capital Markets Limited, also known as FXCM UK, has just posted its annual report for 2017 with the Companies House, with the numbers revealing that the broker stayed in the red, with retail trade volumes down and client funds falling.

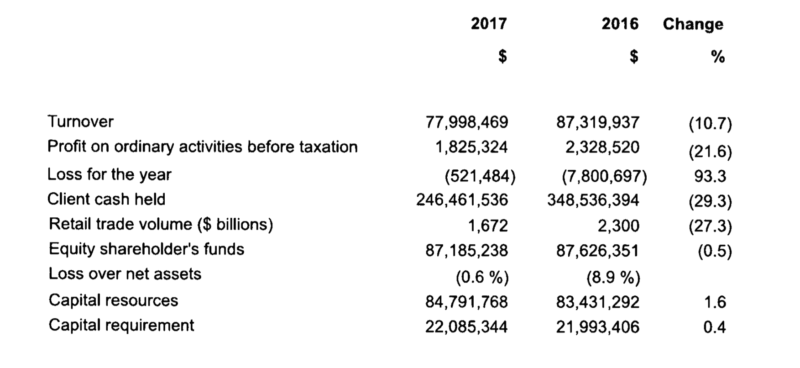

The loss for the year was $521,484, whereas profit on ordinary activities before taxation decreased by 21.6% from the preceding year at $1.83 million. Turnover fell 10.7% in annual terms due to low market volatility, whereas retail trading volumes were down 27.3%. Let’s note the drop of $102 million in client funds.

Interestingly, the report says that FXCM sold its investment in Salex Holding SRL for the price of EUR 1. The agreement for the sale was reached on March 6, 2018, with the buyer dubbed to be a company named FinSalex SRL. As per FXCM’s report, the broker had a 33% stake in Salex, an Italian sales office of the company.

Talking of more recent developments around FXCM, let’s note that the parent of FXCM UK is Forex Trading LLC (FXT), incorporated in Delaware in the United States. On March 29, 2018, the Directors of FXCM UK approved a dividend payment of $5 million to FXT, with the sum paid on March 30, 2018.

Not much was said about the directors’ remuneration. The name of Drew Niv was mentioned only once, with connection to his resignation last year. The aggregate remuneration of FXCM UK’s remuneration in 2017 topped $1.3 million, with the highest paid director receiving $933,896.

In the meantime, we are curious to see what will happen to the compensation package to be received by Kenneth Grossman, the CEO of Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc. Let’s recall that Pursuant to the terms of the Employment Agreement, Mr Grossman was set to serve as Global Brokerage’s Chief Executive Officer until no later than May 31, 2018. He was set to receive (i) compensation of $600,000 per year, and (ii) a bonus of $1,000,000 upon completion of the Employment Term.