FXCM’s US website turns into “Global Home” page, reflecting US market exit

FXCM’s US website is now officially the broker “Global Home” page, as the company obviously progresses in its business restructuring in the aftermath of February events

In a move that is more symbolical rather than news-triggering, FXCM’s US website is now designated as FXCM’s “Global Home” page. This is in tune with earlier developments that saw the website redesigned into what looked pretty much like a landing page.

Any US visitor of FXCM’s website will be shown a message that US residents are not allowed to open accounts with any FXCM entity, with both the live account and practice account options not available to US residents currently. More importantly, the links to FXCM Markets and FXCM UK that used to be included on the page as sources of more information about the broker have been removed. This is a prudent move by FXCM, given that offering of Forex services by overseas companies to US residents is illegal unless these entities are registered and regulated by US authorities.

Moreover, Forex Capital Markets LLC, which used to service the US retail FX market, officially said goodbye to its registration and membership in the US National Futures Association (NFA) on March 10, 2017.

The restructuring

The website changes reflect wider restructuring at FXCM. The change of the trading name of FXCM Inc to Global Brokerage Inc (NASDAQ:GLBR) is just a part of the reshuffle.

The restructuring plan was briefly mentioned in FXCM’s latest annual report, with the company talking about letting go 150 employees, or 19% of the broker’s total workforce, and introducing other non-specified cost-cutting measures. The bulk of the layoffs come from FXCM’s Plano office, according to a report to the Texas Workforce Commission.

FXCM expects to recognize pre-tax restructuring charges of between $4 million and $5 million in the first quarter of 2017, with relation to the restructuring.

What’s left for FXCM in the US?

As per the company’s latest annual report, there are 14 subsidiaries of Global Brokerage, Inc. (this number includes companies in which the broker has a holding) as of December 31, 2016. The state of organization for each of these is Delaware.

The company is planning to sell its stakes in FastMatch, Lucid Markets and V3 Markets.

It is worth noting that FXCM’s disclaimer particularly mentions FXCM Global Services, LLC, incorporated in Delaware. This entity is not regulated.

There are also lawsuits to fight. In response to the settlements published on February 6, 2017, three new putative securities class action lawsuits have been filed against Global Brokerage, Drew Niv, and Robert Lande in the U.S. District Court for the Southern District of New York. The complaints in all of the three actions allege that the defendants violated certain provisions of the federal securities laws and seek compensations for damages. FXCM said it plans to “vigorously defend against the claims asserted in these actions”.

Australia

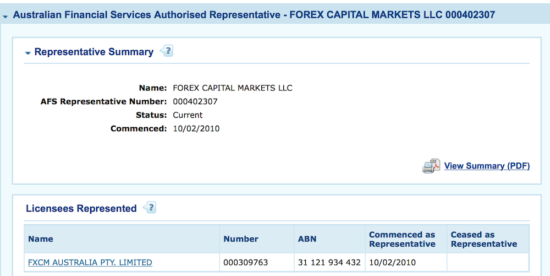

According to the database (ASIC Connect) of the Australian Securities and Investments Commission, Forex Capital Markets LLC is still an authorized Australian Financial Services Representative. The authorization of Forex Capital Markets LLC is current in Australia (as per data sourced earlier today) nearly two months after the publication of the settlements of this company and US regulators. As of March 10, 2017, the US NFA implemented a permanent bar against Forex Capital Markets LLC. Apparently, the Australian regulator is not in a hurry to reflect these changes in its database.