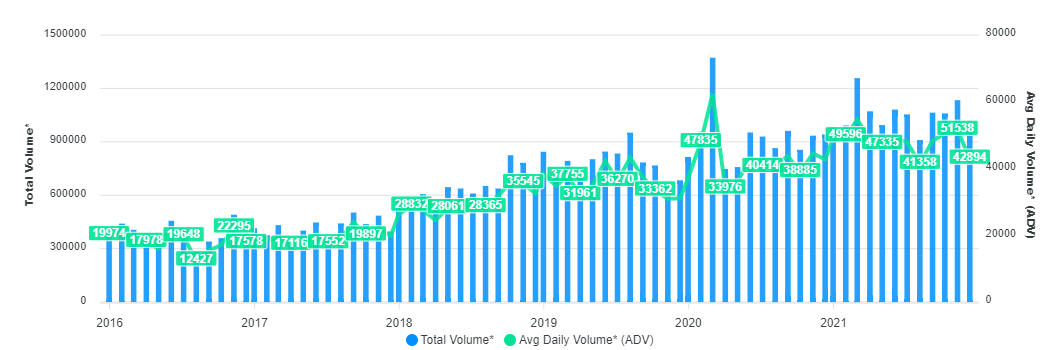

FXSpotStream total volumes drop below $1 trillion in December

Activity on FXSpotStream’s trading venue, the aggregator service of LiquidityMatch LLC, eased last month as the total monthly volumes across its streaming and matching products dropped below the $1 trillion mark.

The company reported an average daily volume of $42.8 billion, the lowest since August.

FX volumes outpaced those of last year, though turnover is still down month-over-month as the lack of clear direction in currency markets continues to affect daily trading activity.

December’s ADV figure was lower on a monthly basis by 17 percent from $51.6 billion back in November 2021. Still, the industry benchmark rose slightly from year-ago levels, when weighed against $42 billion in December 2020.

Following the uptick in activity seen at FXSpotStream LLC in November, the institutional venue has reported that in December 2021, total trading volumes were down even further. The company reported $986 billion for the month, a fall of 13 percent from $1.13 trillion hit back in November.

FinanceFeeds webinar: Expert panel to discuss market data for multi-asset brokerages

The total monthly volume across FXSpotStream’s streaming and matching products was comfortably above the $1 trillion mark in the last two months. The activity got off to a strong rebound as the financial markets kicked off the fourth quarter in high gear, with a multitude of factors helping steer volumes across several venues. These difficult conditions could become increasingly common as investors brace for plenty of hurdles as they move into the holiday season, which pumped up FX hedging trades.

With nobody having a clue so far, other institutional FX platforms, including Cboe FX, CLS, and Thomson Reuters, are also expected to report lower trading activity. The secular trend of mixed FX volumes will stay into play in December as global markets remain hostage to developments involving the coronavirus and central banks’ policies, which are currently top of mind.

FXSpotStream provides a multibank FX aggregation service for spot FX trading. The platform operates as a bank-owned consortium that provides the infrastructure to facilitate the route of trades from clients to liquidity providers.

FXSpotStream’s offering is a client-to-bank platform, with each liquidity taker required to create individual credit relationships with participating banks. This differs from other multi-dealer platforms, such as FX ECNs like Hotspot and EBS Markets that operate with centralized order book systems for their participants.