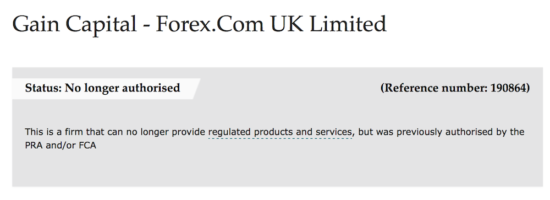

Gain Capital – Forex.Com UK Limited is no longer authorised, FCA Register shows

In line with previously announced plans by the company to return its licenses to the FCA, Gain Capital – Forex.Com UK Limited is no longer authorised by the UK financial regulator.

Gain Capital-Forex.com UK Limited, one of the UK subsidiaries of Gain Capital Holdings Inc (NYSE:GCAP), is no longer authorised by the Financial Conduct Authority (FCA), according to the latest data from the FCA register. The current status of the business – “No longer authorised”, got into effect on October 6, 2017.

The move is in tune with plans announced by the management of Gain Capital-Forex.com UK Limited in the latest annual report submitted by the company to the UK Companies House service. The report stated that:

“Since the company ceased to trade in August 2016 the Directors’ focus for the coming year is to return its licenses to the FCA and to realise the remaining net assets held on balance sheet.”

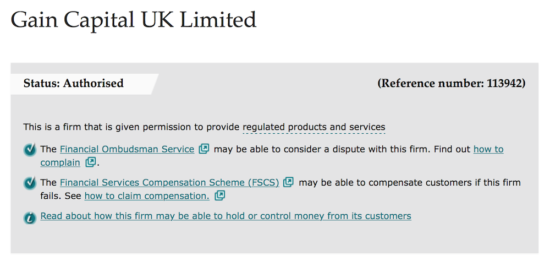

In August 2016, the entire client base of Gain Capital-Forex.com UK Limited was successfully migrated to Gain Capital UK Limited, another UK business of Gain Capital Holdings Inc. Let’s note that Gain Capital UK Limited, which has a dozen trading names/brands in the UK, including City Index and Gain GTX, is currently authorised by the Financial Conduct Authority.

Gain Capital UK Limited, according to SEC filings made by Gain Capital Holdings Inc, is regulated by the FCA as a full scope €730k IFPRU Investment Firm. It is required to maintain the greater of approximately $1 million or the Financial Resources Requirement, which is calculated as the sum of the firm’s operational, credit, counterparty, concentration and market risk. At June 30, 2017, Gain Capital UK Limited maintained $100.3 million more than the minimum required regulatory capital for a total of 2.1 times the required capital.

Concerning the financials of Gain Capital-Forex.com UK Limited , the latest numbers we have for the company come from the annual report for the year to December 31, 2016. Its cash at bank during the year to December 31, 2016, decreased to $13.7 million (down from $63 million in 2015) due to repayment of inter-group loans and the payment of dividends. Gain Capital – Forex.com UK Limited registered a loss after taxation of $3.2 million, compared to a profit of $24 million in 2015. Operating profits fell to $11.65 million, compared to $30.81 million a year earlier.