GAIN Capital marks 25% Y/Y increase in retail client assets in 2017, tax reforms eat into income

After what GAIN called a highly accretive transaction – the acquisition of FXCM’s U.S. client assets in February 2017, the broker continues to review strategic M&A opportunities.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has just posted its key financial and operating metrics for the final quarter and full year 2017, with the report showing a well pronounced rise in retail client assets but also the negative impact of the recent changes in the US tax laws on GAIN’s income.

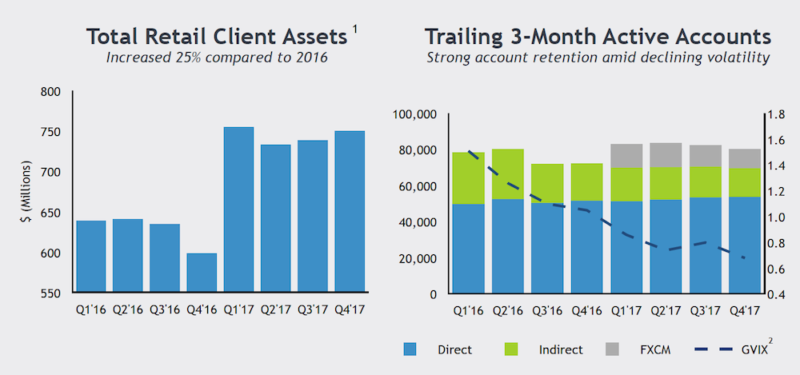

The company reported year-end total retail client assets of $749.6 million, up 25% year-over-year. This was noted by Glenn Stevens, CEO of GAIN, who said the areas of growth included retail client assets and GAIN’s ECN platform, which has been taking market share and increasing trading volume. He added that in the first two months of 2018, thanks to a resurgence of market volatility, the broker is seeing positive returns on its efforts to grow client assets and direct accounts.

In line with previous announcements, GAIN stressed that the deal for acquiring the accounts of clients of FXCM’s US retail Forex business in February this year has been highly accretive, with total cost of $7.2 million and CTR of $15.5 million. In its latest presentation to investors, GAIN says that it continues to review strategic M&A opportunities.

With regard to its retail FX business, GAIN keeps building its offering. In line with a strategy unveiled in its presentation for the third quarter of 2017, Forex.com launched Bitcoin trading in the final quarter of last year. Also, Gain Capital’s UK business started offering GetGo – an innovative, trade signals app for novice traders. The global rollout of the solution is planned for 2018.

The financial picture for the year was seriously affected by the U.S. Tax Cuts and Jobs Act. The tax reforms resulted in a $3.1 million (or $0.10 per share) decrease in adjusted net income for the full year. The drop was $5.7 million, or $0.13 per share, for the fourth quarter of 2017. (Update – March 12, 2018 – Earlier today, GAIN posted an update with regard to the tax reforms impact. The update states: “Removing the impact of the U.S. Tax Cuts and Jobs Act on GAAP net loss, net income in the fourth quarter would have been a net profit of $1.2 million or $0.03 per share, while the full year would have been a net loss of $6.3 million or $0.10 per share.”)

The company incurred a $3.7 million net loss in the final quarter of 2017 compared to a net profit of $20.8 million for the equivalent period a year earlier. The net loss for the full year to end-December 2017 was $11.2 million, compared to a net profit of $35.3 million in 2016.

Net revenue of $308.6 million for the year and $69.7 million for the fourth quarter 2017, down from $411.8 million and $115.8 million, respectively.

Adjusted EBITDA also fell. It amounted to $35.1 million for the year, down from $99.6 million in 2016. Adjusted EBITDA for the fourth quarter of 2017 was $7.3 million, down from $36.9 million registered in the same period in 2016.

More information is set to be provided in GAIN’s Annual Report for 2017 with the Securities and Exchange Commission.