GAIN Capital marks rise in revenues, registers $0.7m net loss in Q4 2018

In the face of the net loss recorded in the final quarter of 2018, the annual performance was robust, with net income for 2018 reaching $28 million.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has earlier today posted its key financial and operating metrics for the final quarter and full year 2018.

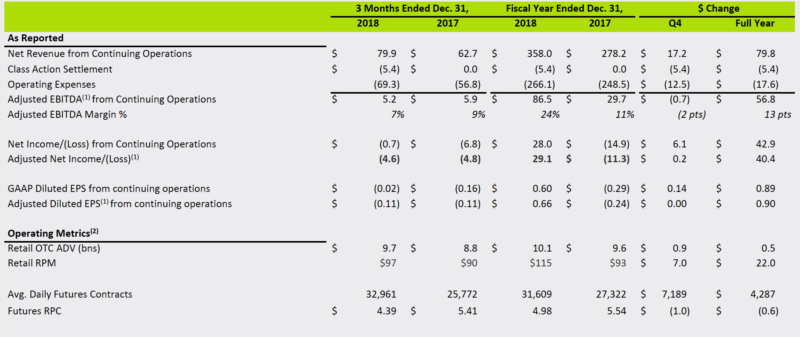

Following a rather solid third quarter, when the broker registered net income of $10 million, the final quarter was not so rosy. GAIN registered a net loss of $0.7 million during the final three months of 2018. This compares to a loss of $6.8 million registered in the year-ago quarter.

On the brighter side, the net revenues for the fourth quarter of 2018 were $79.9 million, up from $62.7 million registered in the final quarter of 2017.

The annual performance was robust, as GAAP net income reached $28 million in 2018, or $0.60 per share, yielding an 8% margin, compared to a net loss of $14.9 million, or $(0.29) per share a year earlier. GAAP net revenue was $358 million, up 29% year-over-year in 2018.

Adjusted net income totalled $29.1 million, or $0.66 per share in 2018, compared to a loss of $11.3 million, or $(0.24) per share in 2017. Adjusted EBITDA amounted to $86.5 million, compared to $29.7 million in 2017, yielding a 24% adjusted EBITDA margin.

In the fourth quarter, GAIN focused on returning capital to shareholders through buybacks, the modified Dutch auction, and dividends which amounted to approximately $54.2 million.

For the full year 2018, excluding the modified Dutch auction, GAIN repurchased 1,839,060 shares of stock at an average price of $7.33. Including the modified Dutch auction, during the full year GAIN repurchased 8,216,611 shares of stock at an average price of $7.73.

For the twelve months ended 2018, GAIN returned a total of $73.8 million to shareholders in the form of share repurchases and dividends.

GAIN’s Board of Directors declared a quarterly cash dividend of $0.06 per share of the Company’s common stock. The dividend is payable on March 29, 2019 to shareholders of record as of the close of business on March 26, 2019.

Glenn Stevens, Chief Executive Officer of GAIN Capital, commented:

“Looking ahead, we are well positioned to drive robust business growth over the next several years. We are embarking on a three-year strategic plan designed to power the next phase of GAIN’s success, which involves leveraging our considerable brand assets, further increasing our investment in marketing and building a best in class client proposition tailored to the needs of experienced traders and retail investors. We will deploy our strong balance sheet and profits to fund these strategic initiatives, while maintaining our focus on operational excellence and cost discipline, to deliver significant revenue growth and improved earnings over the next several years.”