GAIN Capital pays $5.1 million for FXCM US client accounts in Q1’2017

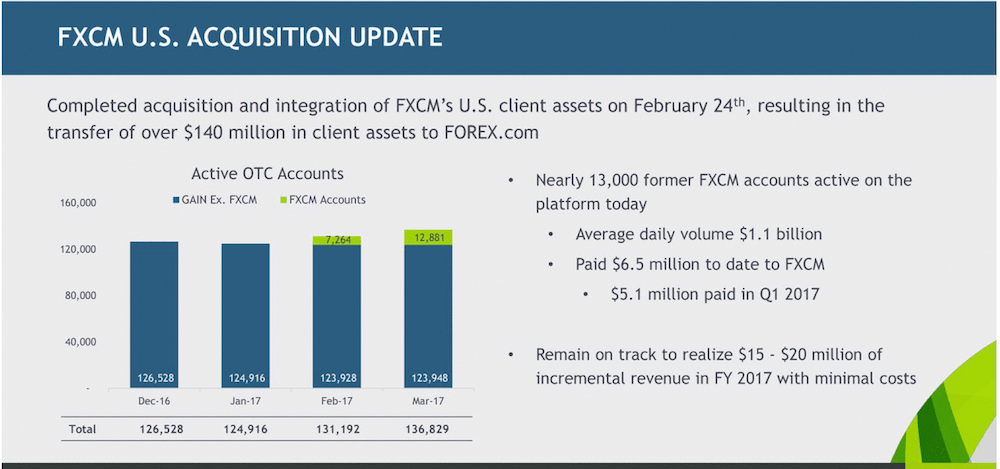

GAIN claims that almost 13,000 client accounts traded actively during the quarter post-migration.

Almost three months have passed since Gain Capital Holdings Inc (NYSE:GCAP) entered into a definitive agreement to acquire the US retail client accounts of FXCM, which had to leave the US market in line with settlements with the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

Details of the deal have shown that GAIN is making no upfront payment, but will instead pay FXCM based on the trading activity of the transferred accounts. GAIN Capital is set to pay $500 for every transferred client account that executes at least one new trade during the first 76 calendars days of the 153-day period following the closure of the purchase agreement. The sum is $250 for an account from which at least one new trade is executed during the period from the 77th day through the 153rd day.

In the end of February this year, GAIN said that some 47,000 client accounts had been successfully transferred from FXCM to GAIN’s Forex.com.

Today, as GAIN Capital posted its financial report for the first quarter of 2017, it also provided a brief update on the activity of the migrated accounts and the respective sum paid to FXCM. GAIN said that 13,000 accounts were actively trading during the first quarter. In the quarter, GAIN paid $5.1 million to FXCM in line with the acquisition agreement.

The proceeds from the sale of FXCM’s US retail accounts, as Leucadia has announced in its report for the first quarter of 2017, are for the repayment of the law that Leucadia had extended to FXCM in the aftermath of the Swiss franc crisis in January 2015. Leucadia’s latest report revised its estimate for a maximum exposure to loss as a result of its involvement with FXCM to $319.5 million. The number comprises the carrying value of the term loan ($132.8 million) and the investment in associated company ($186.7 million).