GAIN Capital registers net income of $0.9m in Q2 2019

Net income was markedly down from a year earlier, but GAIN’s CEO noted that pockets of volatility in the British Pound and major indices increased in revenue capture.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has earlier today posted its key financial and operating metrics for the second quarter of 2019, with revenues and profits down from the year-ago quarter.

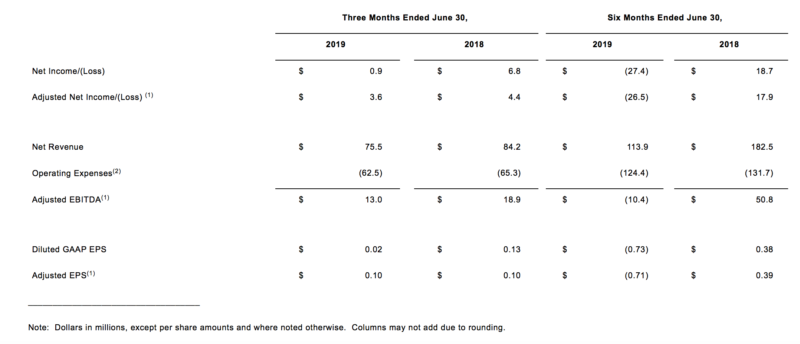

- GAAP net income for the three months to end-June 2019 was $0.9 million, down from $6.8 million in the corresponding period a year earlier. Earnings per share in the second quarter of 2019 amounted to $0.02.

- GAAP net revenue in the three-month period to June 30, 2019 was $75.5 million, down from $84.2 million in the year-ago quarter.

- Adjusted net income totalled $3.6 million in the second quarter of 2019. Adjusted EBITDA for the peeriod was $13 million.

- New direct accounts increased 83% year-over-year and 5% quarter-over-quarter in the three-month period to end-June 2019.

Glenn Stevens, Chief Executive Officer of GAIN Capital sought to strike an optimistic note by saying that “Q2 results, while mixed, showed positive signs of increased client engagement which will benefit GAIN and drive trading revenue upon the return of market volatility”.

“Market conditions remained challenging during the second quarter and the Eurodollar, our most traded product, was even more tightly range-bound than the previous quarter’s record, impacting overall client activity and volume. Despite these headwinds, pockets of volatility across the British Pound and major indices helped drive Q2 revenue per million of $130, improving the trailing twelve month average by 6% to $110. Looking ahead, we are well-positioned to drive future trading revenue upon the return of volatility as we’ve seen an increase in open client positions and continued growth in new direct accounts and direct active accounts,” Glenn Stevens commented.

In the second quarter of 2019, GAIN focused on returning capital to shareholders through dividends, which amounted to approximately $2.2 million. The company repurchased 497,106 shares of stock at an average price of $5.61. GAIN returned a total of $5 million to shareholders in the form of share repurchases and dividends.

GAIN’s Board of Directors declared a quarterly cash dividend of $0.06 per share of the Company’s common stock. The dividend is payable on September 27, 2019 to shareholders of record as of the close of business on September 23, 2019.