GAIN Capital registers net income of $10m in Q3 2018

Although the net income in the third quarter was well below the result for the second quarter, the revenues marked growth in quarterly terms.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has earlier today posted its key financial and operating metrics for the third quarter of 2018, with volatility in emerging markets supporting growth in revenues.

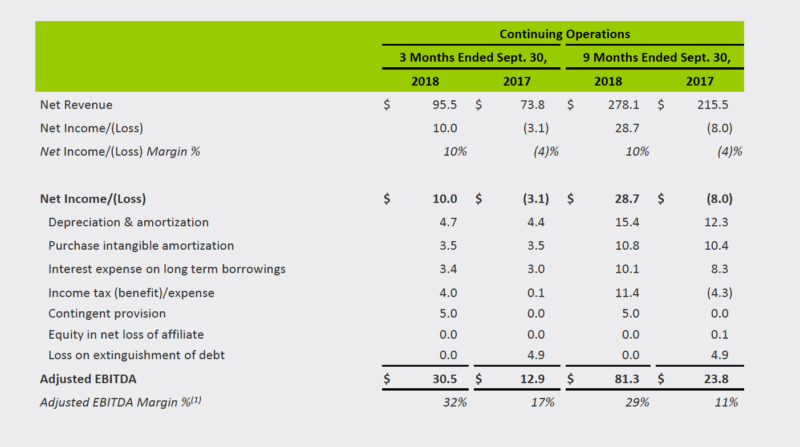

Net revenues in the three months to September 30, 2018 increased 30% year-on-year to $95.5 million. This is also higher than the result of $84.2 million registered in the second quarter of 2018.

Net income for the third quarter of 2018 was $10 million, lagging behind the result for the second quarter of 2018. However, the net income result for the third quarter of 2018 was much better than the loss of $3.1 million incurred in the third quarter of 2017.

“While overall low market volatility continued to weigh on retail trading volumes during the quarter, our diverse product offering enabled strong revenue growth,” commented Glenn Stevens, Chief Executive Officer of GAIN Capital.

“Volatility in emerging markets, along with trade tensions, prompted high trading activity in emerging market currencies, as well as certain metals and index products, which helped to generate overall revenue capture of $164 per million for the quarter. In addition, our continued focus on organic, direct account growth and marketing initiatives helped deliver strong operating results in Q3, with new direct accounts up 28% year-over-year. As reiterated through our recently announced $50 million tender offer, we are firmly committed to executing a balanced capital allocation strategy to enhance shareholder value.”

The broker said it launched a new web trading platform in the UK and Asia Pacific region in the third quarter. The platform is scheduled to launch in the United States in the fourth quarter. GAIN’s FX DMA offering was launched in the United States, with a global rollout planned from the first quarter of 2019.

Six months into the new automated hedging model implementation, GAIN says it continues to see positive results. The model has been rolled out initially for FX and GAIN aims to extend it to other asset classes in 2019.

The operating metrics for the three months to end-September 2018 were solid, as new direct accounts increased 28% year-over-year and 23% quarter-over-quarter. The futures segment margin doubled to 14% for the first nine months of 2018 as compared to 7% for the nine months ended September 30, 2017.

GAIN’s Board of Directors declared a quarterly cash dividend of $0.06 per share of the Company’s common stock. The dividend is payable on December 18, 2018 to shareholders of record as of the close of business on December 11, 2018.

On October 9, 2018, GAIN commenced a “modified Dutch auction” tender offer to purchase up to $50 million of its outstanding shares at the maximum price of $7.94 and minimum price of $7.24. The tender offer is scheduled to close on November 6, 2018, unless otherwise extended by GAIN. The Company believes the tender offer is a prudent use of financial resources given available liquidity, including proceeds from the sale of GTX, and the current market price of its shares.