GAIN Capital registers net income of $14.3m in Q2 2020

GAIN’s CEO said the acquisition by StoneX Group remains on track to complete later this quarter.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) has just posted its financial results for the second quarter of 2020, with earnings marking a rise in annual terms.

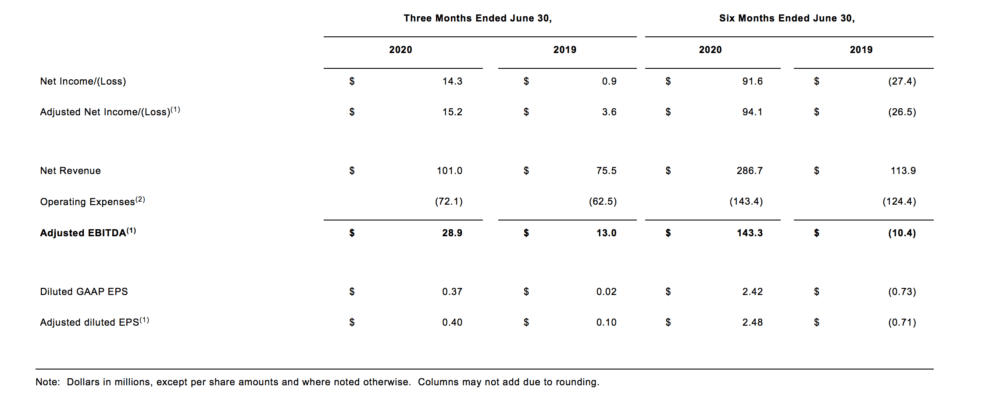

GAAP net income for the three months to end-June 2020 amounted to $14.3 million, or $0.37 per diluted share. This compares to net income of $0.9 million a year earlier.

GAAP net revenue totalled $101.0 million, up from $75.5 million a year earlier.

Adjusted net income for the second quarter of 2020 was $15.2 million, or $0.40 per diluted share, whereas Adjusted EBITDA was $28.9 million.

In terms of operating metrics, the brokerage noted the rise in trading volumes on the back of high volatility. Trailing 3-month direct active accounts increased 34% over prior year to a quarterly record 93,433. RPM reached $150, with average daily volume of $9.1 billion, 28% above the same quarter in the prior year.

Glenn Stevens, CEO of GAIN Capital, commented:

“A second quarter of high volatility, due in part to the ongoing economic concerns over the COVID-19 virus, allowed Gain to continue to benefit from high daily volumes, up 28% year on year, revenue capture of $150 plus improved operational leverage arising from a successful focus on cost efficiency over the past 2 years. Adjusted EBITDA was more than double the prior year’s at $29m, a margin of 29% compared to last year’s 17%, with adjusted EPS of $0.40 taking the half year to $2.48 earnings per share”.

“In addition, we look forward to the closing of the acquisition by StoneX Group (formerly INTL FCStone Inc.), which remains on track to complete later this quarter,” added Mr Stevens.

The deal was initially announced in February this year. Under the terms of the agreement, StoneX will acquire GAIN in an all-cash transaction. GAIN’s stockholders will receive $6.00 per share, representing approximately $236 million in equity value.

The transaction represents a 70% premium to the closing share price of GAIN’s shares on February 26, 2020 and a 60% premium to the volume-weighted average price of GAIN’s stock in the 30 trading days ending on February 26, 2020.

Shareholders of Gain Capital have backed the proposed acquisition. At a special meeting of stockholders held on June 5, 2020, holders of approximately 71.2% of GAIN’s shares issued and outstanding as of the close of business on the record date voted in favor of the proposal to adopt the merger agreement, representing approximately 85.7% of votes cast (excluding abstentions).