GAIN Capital reports 14.61% increase in Q3 revenues; predicts $40-$45 million cost synergies on City Index integration by Q4 2016

North American electronic trading giant Gain Capital Holdings Inc (NYSE:GCAP) has today announced its net revenue for the third quarter of 2015, registering a dramatic increase at $127.9 million compared to $111.6 million in the second quarter of the year. Glenn Stevens, CEO of GAIN Capital today made a commercial statement on the results: “This […]

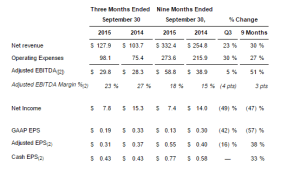

North American electronic trading giant Gain Capital Holdings Inc (NYSE:GCAP) has today announced its net revenue for the third quarter of 2015, registering a dramatic increase at $127.9 million compared to $111.6 million in the second quarter of the year.

Glenn Stevens, CEO of GAIN Capital today made a commercial statement on the results:

“This quarter reflects GAIN’s continued success in executing its strategy, particularly relating to the scaling and diversification of our retail business.”

“Reflecting the increased diversification of our retail revenue, four product groups contributed significantly to our total retail revenue for the quarter, with each achieving in excess of $10 million in revenue,”

“Non-FX products represented 50% of retail revenue year-to-date, which further illustrates GAIN’s progress on its diversification strategy. Third quarter average daily OTC volume of $15.6 billion represents an increase of 30% over the same period last year and reflects the impact of GAIN’s acquisition of City Index, as well as its ability to grow active accounts.”

“The integration of City Index is on track to achieve $40-$45 million in run-rate cost synergies by Q4 2016, with several significant milestones achieved during the quarter. We believe achievement of the targeted synergies and continued cost rationalization provide GAIN with a significant opportunity to continue to expand our margins.”

Retail Business

In the third quarter of 2015, GAIN’s retail business generated net revenue of $118.8 million, up from $90.4 million in the third quarter of 2014 (down 5% on a pro forma2 basis).

The retail OTC business contributed $100.9 million of net revenue, up 55% from $64.9 million in the third quarter 2014 (up 3% on a pro forma2 basis). For the quarter, GAIN’s futures business generated $12.5 million of net revenue. Other retail revenue was $5.4 million in the quarter.

Average daily retail OTC trading volume was $15.6 billion, up 70% from $9.2 billion in the third quarter of 2014 (up 25% on a pro forma basis). Average daily futures contracts were 34,429, up 29% from 26,736 in the third quarter of 2014.

Institutional Business

In the third quarter of 2015, net revenue from the GTX business was $8.3 million, compared to $8.5 million in the prior year quarter. Average daily volume for GTX was $16.7 billion in the quarter, an increase of 1% from the prior year quarter.

Dividend

GAIN’s Board of Directors declared a quarterly cash dividend of $0.05 per share of the Company’s common stock. The dividend is payable on December 22, 2015 to shareholders of record as of the close of business December 11, 2015.