GAIN Capital revamps FOREX.com Mobile app

FOREX.com Mobile re-emerges with new My Dashboard and Market screens, as well as with enhanced watchlist features and streamlined Trade Ticket.

Ever since Gain Capital Holdings Inc (NYSE:GCAP) acquired the US customers of FXCM transferring them to its retail FX business FOREX.com and boosted the trading functionalities by adding new capabilities like TradingView charts, we have been expecting that significant changes will be made to the mobile applications offered by FOREX.com.

The changes have finally arrived, with FOREX.com Mobile for iOS devices having re-emerged completely revamped.

The key purpose of FOREX.com Mobile is to provide traders with access to a variety of markets including currencies, commodities and indices while on the go.

The list of main features of the application include a range of simple and advanced order types, as well as advanced charting functionalities. There are also real-time rate alerts and customized watch lists, as well as market insights and research provided by Forex.com’s Global Research Team.

The key aim of the revamp of the application is to provide traders with a more streamlined experience and make it easier for them to manage their account and trade.

The key aim of the revamp of the application is to provide traders with a more streamlined experience and make it easier for them to manage their account and trade.

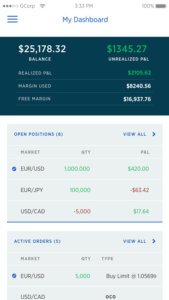

One of the new features in the latest version of the solution (3.1.0) is a new My Dashboard screen which offers a summary of the activity in one’s account including balances, positions, active orders, and watch lists.

There is also a new Market screen that “drills” into a specific currency pair and streamlines information. In addition, the streamlined Trade Ticket now includes required margin, margin available and pip value of the trade.

The watchlist features have also been enhanced.

FOREX.com joins the number of companies that keep investing resources into updating their mobile solutions. OANDA, for instance, has recently released a new version of the OANDA fxTrade Forex Trading app, with the enhancements focusing on alerts and notifications.

There are only a handful of retail FX brokers left in US market, so it is normal that the focus of traders increasingly falls on the quality of services offered by these brokers. The expectations are also high as companies like GAIN Capital and OANDA have to defend their reputation as regional leaders now.