GAIN Capital’s earnings rise in Q1 2018, as retail and institutional volumes grow

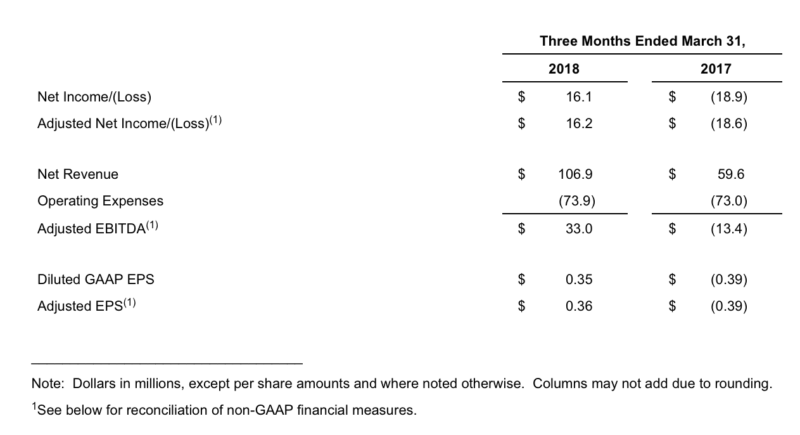

The company registered a net income of $16.1 million, compared to a loss of $18.9 million a year earlier.

Online trading major Gain Capital Holdings Inc (NYSE:GCAP) saw a solid first quarter of 2018, as has been demonstrated by the set of financial and operating metrics the broker has just posted.

After a challenging final quarter of 2017, the company managed to register a (GAAP) net income of $16.1 million in the first three months of 2018. This compares to a net loss of $18.9 million registered in the corresponding period in 2017.

Net revenue was also robust, staging a rise of 79.4% year-over-year and reaching $106.9 million.

The financial metrics reflected solid operating results. Retail average daily volumes increased 31% year-over-year to $12.4 billion in the first quarter of 2018, whereas institutional ECN average daily volume increased 26% year-over-year to a record high of $14.8 billion. The number of new direct accounts rose 24% from the equivalent period in 2017.

GAIN’s Chief Executive Officer Glenn Stevens called the quarter a strong one and highlighted the growth in revenues, as well as the margin expansion to 31%, as well as the robust overall operating metrics, especially within the retail business.

“A return to more normalized volatility levels provided a market environment in which GAIN was able to showcase the benefits of our investment in organic initiatives over the past year. Customer engagement was up across the board, with retail average daily volume up 31% year-over-year and Institutional ECN average daily volume up 26% to reach a record high of $14.8 billion”, he noted.

During the first quarter of 2018, GAIN focused on returning capital to shareholders through dividends, which amounted to approximately $2.6 million. The company repurchased 580,064 shares of stock at an average price of $7.20 and returned a total of $6.8 million to shareholders in the form of share repurchases and dividends.

GAIN’s Board of Directors declared a quarterly cash dividend of $0.06 per share of the company’s common stock. The dividend is payable on June 19, 2018 to shareholders of record as of the close of business on June 12, 2018.

Let’s note that GAIN is embracing AI. It started implementing a new AI-driven hedging model in late Q1 in order to reduce quarterly RPM. This has been rolled out for FX in March, with additional asset classes to follow.

The broker also provided an update on how its services develop. For instance, the new web platform is now in Beta, whereas GAIN plans to roll out an Android version of its GetGo mobile app in May 2018.