GAIN Capital’s GetGo app set to land in Australia

The developers have been working on the last set of tweaks before launching the mobile solution in Australia.

More than two months have passed since the team behind GetGo, the innovative mobile trading application offered by online trading major Gain Capital Holdings Inc (NYSE:GCAP), said it had prepared the application to go international. Back then, the solution got the functionality to accept USD, AUD and EUR accounts.

There appears to be some development in this respect. In a brief update accompanying the release of version 1.0.13 of the GetGo mobile application for iOS devices, the developers state that this version features a “last set of tweaks before launching in Australia”.

This marks an important step for the app, which was initially rolled out by GAIN Capital in the UK in December 2017. The company said back then that it planned to make the solution available in other markets throughout 2018. Apparently, the stage is being set for the expansion.

The solution is now available to a wider clientele – in June this year, the GetGo app became available to owners of Android devices. It remains to be seen whether the iOS and Android versions of the solution will be offered to the Australian traders or the company will start by offering the app for iOS devices first.

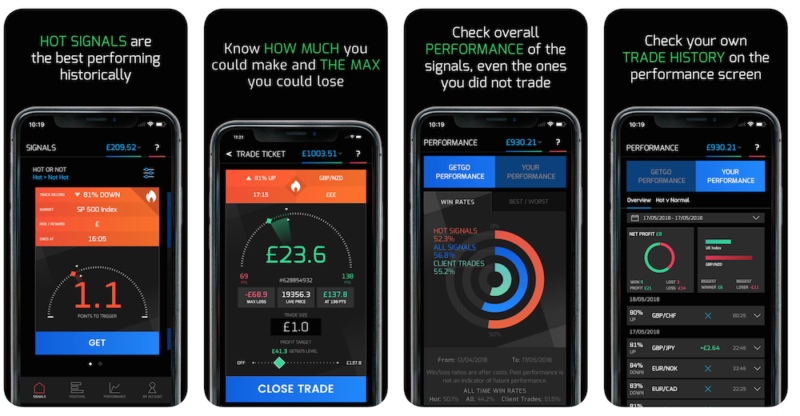

The GetGo application harnesses the capabilities of a smart AI-enhanced algorithm to spot statistical trends in financial markets and provide users with trading signals based on historical data. GetGo’s algorithm reads through millions of data points across global indices, currency and commodities markets looking for price patterns that have led to consistent trading outcomes in the past. When it spots a pattern it thinks might repeat, it pings a user a signal. Then traders have to decide: GetGo or No-Go? And that is where the app gets its name from.