GAIN Capital’s GetGo mobile app adjusts risk warnings

The popup message that tells clients not to place too much of their funds on any one trade is now displayed when users risk over 10%.

The latest version of GetGo, the innovative mobile trading application that online trading major Gain Capital Holdings Inc (NYSE:GCAP) launched in December last year, aims to offer better risk management.

Version 1.0.7 of the application for iOS devices, which has been released a couple of days ago, includes a number of enhancements, including adjusted risk warnings. The application has a popup which tells clients not to place too much of their funds on any one trade. Previously, this message was displayed when users risk over 20% but, in the latest version, this level has been moved down to 10%. Placing trades with a smaller percentage of one’s account balance means less erratic returns, the developers note.

The update was rolled out shortly after the European Securities and Markets Authority (ESMA) announced that it has agreed on measures on the provision of contracts for differences (CFDs) to retail investors. The measures include, inter alia, standardized risk warnings and leverage caps.

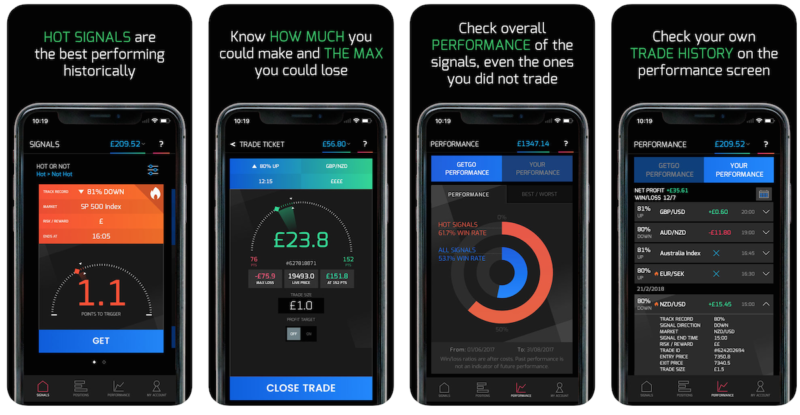

GetGo uses a smart AI-enhanced algorithm to spot statistical trends in financial markets and provide users with compelling trading signals based on historical data. GetGo’s algorithm reads through millions of data points across global indices, currency and commodities markets looking for price patterns that have led to consistent trading outcomes in the past. When it spots a pattern it thinks might repeat, it pings a user a signal. Then traders have to decide: GetGo or No-Go? And that is where the name of the app comes from.

The app aims to be pretty clear. Instead of confusing charts, there is a series of straightforward choices: How much do you want to make? How much are you prepared to lose? Do you want to monitor your trade or let GetGo manage it for you?

GetGo shows users the trading opportunity, sets a price for the trade to trigger and the end time at which the trade will close. Traders decide whether or not to trade before the time runs out. Every signal comes with an automatic guaranteed stop loss, so that users of the app can trade with confidence.

The app was initially launched for clients of GAIN Capital UK but the broker has voiced its plans to roll out the solution in additional markets in 2018.