GAIN Capital’s GetGo mobile app enhances performance page transparency

The performance page now shows the win rate for client trades in a given time period, which is updated on a weekly basis.

GetGo, the innovative mobile trading application offered by electronic trading major Gain Capital Holdings Inc (NYSE:GCAP), continues to enjoy improvements. The latest set of enhancements concerns the performance page, which now offers more data to users of the solution.

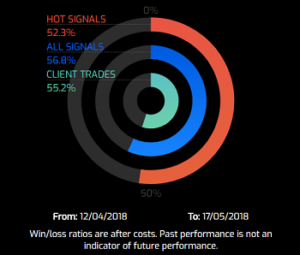

The team behind GetGo has figured that as well as sharing win rates of the signals with the orange (Hot signals) and blue circles (all signals), it had to show how users’ traders are doing. Hence, the green circle now shows the win rate for client trades in the given time period, which is updated on a weekly basis.

The team behind GetGo has figured that as well as sharing win rates of the signals with the orange (Hot signals) and blue circles (all signals), it had to show how users’ traders are doing. Hence, the green circle now shows the win rate for client trades in the given time period, which is updated on a weekly basis.

In the latest release of the app, the team has focused on tweaks to the onboarding journey for new clients, further changes in preparation for making GetGo available internationally, and tweaks that make the handling of users’ data safer and more secure as well as compliant with the latest regulations on data protection (GDPR). On GDPR, existing clients will find a “Let’s stay in touch…” email from GetGo in their inbox – to keep hearing about all things GetGo, they have to hit the “Opt me in” button in that email.

Lately, the GetGo team has also been busy creating and recording GetGo trading tips – the #7tipsin7days series. This is a welcome kit for everyone who is about to start trading on GetGo, those who would like to give GetGo a try but are unsure where to start from, and those who do not feel like they have enough knowledge of the app to get going.

Let’s recall that the solution was initially rolled out by GAIN in the United Kingdom, with the company planning to launch the solution in other markets throughout 2018. Earlier this month, the company said it had prepared the application to go international, as it started accepting USD, AUD and EUR accounts.

The app is currently available to users of iOS devices, but the launch on Android is coming soon. In fact, during the presentation of its results for the first quarter of 2018, GAIN said the release of GetGo on Android devices was set to happen in May 2018.