GBP makes biggest leap in 8 years as the market reacts to Brexit / Bremain

As the UK referendum draws near, British confidence is on the pound, property investment and stable banking institutions as the most valued currency in the world rallies to highest point since pre-financial crisis.

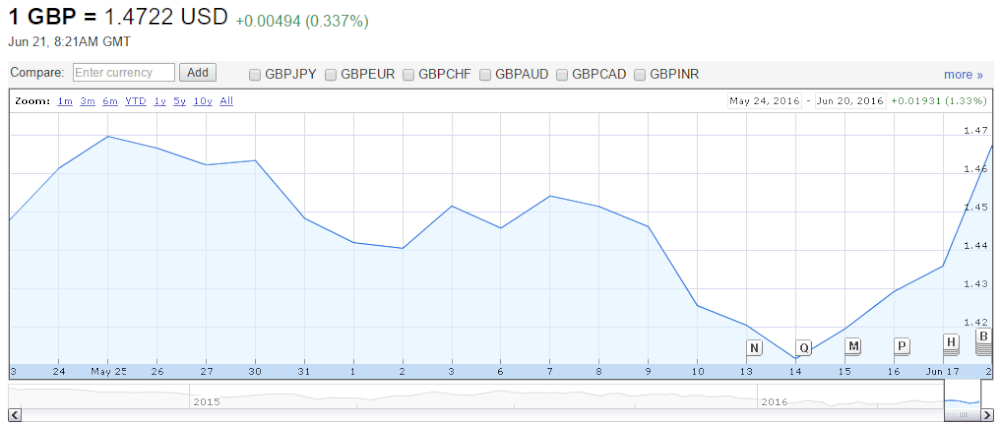

Yesterday, the British pound rallied to its highest value since October 2008, almost hitting 1.48 against the US dollar as Britain’s markets across all asset classes experienced a sharp rise.

This morning, the British pound remained up 0.3% against the US dollar, at 1.477 which is a remarkable market spike at a time during which the British public are anticipating the counting of the votes at the end of this week which will reveal how the British public decides the future of the nation’s European Union membership, or sovereign independence.

This increase in value shows that there are certain aspects of Britain’s economic fabric which are prized possessions and are likely to continue to be very valuable assets should the country remain part of the European Union.

The pound has long been heralded as the world’s most valuable currency, and despite George Soros’ vocal speculation today that Britain’s currency markets would be catastrophically affected by an exit from the European Union which would be “worse than Black Wednesday”, alluding to the market crash of 1992, investors are showing confidence in the pound.

Other assets are largely state-owned banks such as Royal Bank of Scotland and Lloyds Banking Group, which have been the subject of share price increases of collectively more than 7% yesterday, and property is still a very secure asset in Britain.

In mainland Europe, security of property is a very different matter to in Britain, with many people renting homes, whereas in Britain, home ownership is 64.8% compared to 52.5% in Germany, the potential demand for new homes should Britain remain in the European Union is stoking interest in major construction companies.

Britain’s freedom of movement that Britain’s European Union membership affords means that new homes are in high demand, and as a result, the market confidence when looking at a potential vote to remain in the European Union shows that shares in Britain’s largest builders, Taylor Wimpey and Barratt Developments climbed more than 6%.

The FTSE 100 index rose 2% yesterday also.

Britain’s largest financial services company, Hargreaves Lansdown, whose founder Peter Hargreaves is a commited pro-Brexit commentator, has analyzed this comprehensively.

This morning, FinanceFeeds spoke to Laith Khalaf, a Senior Analyst at the company’s Bristol headquarters, who explained “Waves from the Brexit vote are buffeting the UK stock market, tossing it up and down as the opinion polls shift this way and that.”

Mr. Khalaf continued “Until the vote is over we can expect more price swings, as markets struggle to price in a unique event that carries with it such a high degree of uncertainty.”

“If you want to get an idea of what stocks will do well in the event of a vote to stay in the UK, it’s worth taking a look at the FTSE leaderboard. The market has clearly identified financials and housebuilders as beneficiaries of a vote to remain in the UK, with a sterling rally also indicating how the currency might move if we vote to remain in Europe” he concluded.

Stock in publicly-listed Hargreaves Lansdown actually rose higher than any other British financial institution yesteday in percentage terms, with a 7.8% increase in share prices at close of business yesterday, representing a 96p increase per share.

Hargreaves Lansdown conducts its entire business within Britain, and operates the proprietary Vantage platform which allows retail investors to manage their entire portfolio from one platform. The company also operates HL Markets, which is a white label of IG Group.

There are those who consider a ‘remain’ outcome to mean a future of higher house prices and lower salaries and pensions, therefore these predictive spikes that have occurred over the last day may be subject to equal lows following the outcome, therefore this can be considered the initial part of high levels of volatility across the board as speculation as to which way the vote will go continues.