Are you getting a fair deal? We look at pricing and execution as anomalies appear

Just how are your trades being priced compared to what is being displayed? We investigate

One of the most critical factors in maintaining a fully functioning OTC electronic trading business is the ability to provide genuine market pricing via aggregated Tier 1 price feeds, and to demonstrate this to customers, those being brokers or direct retail clients.

FinanceFeeds has long maintained that there are only a handful of genuine prime of prime brokerages in existence globally, those being companies that adhere to the definition of being able to provide genuine liquidity via prime brokerage relationships with Tier 1 FX dealing banks, and also which can demonstrate an order trail to a customer from its origin right to its execution.

During several conversations with industry leaders in London last week, this perception was strengthened further, as differences in spreads and execution were highlighted between what is advertised by many liquidity providers, compared to what is being delivered.

In terms of choosing a liquidity partner, brokerages should look carefully at whether the firm in question is a genuine prime of prime brokerage and has actual Tier 1 liquidity relationships with the major banks, largely centralized around London’s square mile and Canary Wharf, as well as relationships with rising non-bank providers such as Citadel Securities and XTX Markets, and are able to process orders via the banks and the non-bank providers with zero resistance.

Order trails should be presentable to brokerages, and thus to direct customers. In our opinion, the only firms able to do this currently are Saxo Bank, ISPrime, CMC Markets, Swissquote, Advanced Markets, Invast, and Sucden Financial.

The restriction in counterparty credit allocation to OTC derivatives firms has required large balance sheets and continued relationships in order to provide a comprehensive service to brokerages, hence the stalwarts of the industry now stand ahead, and are liquidity partners that will be able to provide full transparency with regard to order execution and price allocation.

The rise of several companies which consider themselves to be liquidity providers, and in some cases use (misuse?) the word Prime in order to attract corporate business rather than retail customers to the very same order feed, has led to a large degree of ambiguity, and is not just a moot point among small brokers looking to choose the right liquidity provider, but is now a sticking point among many London-based senior executives of the institutional sector who are reluctant to tolerate such misuse and potential damage to our industry.

And quite right too.

One particular practice that has come to light is something that is prevalent among new entrants which have less ease in finding Tier 1 liquidity providers. FinanceFeeds is aware of a case in which a liquidity provider had been saddled with uncompetitive spreads, thus had missed out on a significant amount of market share, before finding a new liquidity provider and then heavily advertising the spreads offered via that relationship.

Whilst there is nothing intrinsically wrong with that, as it is not disingenuous in itself, this is a means of onboarding clients whilst low spreads are displayed before such spreads vanish. That particular company is no longer advertising such low spreads.

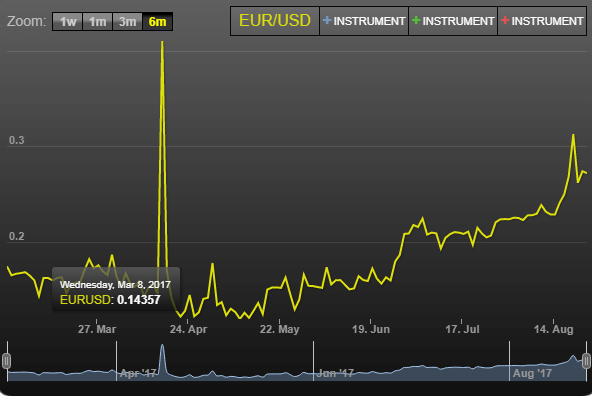

In this case, an interbank executive pointed out to FinanceFeeds that the recorded average spread for a specific trade was 0.54 pips, however the diagram here of the spreads reported on the website differ, thus the advertised spread is 20% lower than the recorded average.

FinanceFeeds was provided with the raw tick data by an interbank dealer, which bore this out.

In this particular case, FinanceFeeds contacted the company in question, whose CEO was extremely defensive.

When showed the raw tick data from the bank, the response was “That’s kind of nonsense don’t you agree? You can see the range of spreads over a day and how averages become a nonsense. We process well over 200 million orders (price updates) a day. Neither this data set or any website would record all those updates – it’s a lot of data. I can assure you we have 1 order book and all prices LIVE and on our website come from that order book.”

It was assumed that the source was a disgruntled client, however it was quite the opposite, as our research was at the interbank side.

Maintaining that full access was available to all customers, a further response was “This is a waste of everyone’s time. Customers have full access to us, but you need to look at all the numbers, all the data points and the processes the third party has used. Who knows what we are actually comparing here. I certainly don’t. A deep statistical dive I am fully in favour of because the source of the data is exactly the same. Any difference can only be through translation of the same data through different processes. I repeat the data source is the same so the answers will invariably be the same.

The data was disseminated by the liquidity provider, who said “We had a quick look and it resembles the top of book price for the date in question. Nothing too surprising in there. We don’t ever “advertise” spreads and certainly never fixed because that’s impossible on a central limit order book, our spreads are live as displayed on the website.”

Thus there may well be two sides here, however the difficulty is working out where the relationships lie and how effective they are.

Visiting large introducing brokers and retail FX brokerages in China is a good yardstick. The companies which have substantial market penetration in China’s second tier development towns such as Shenzhen, Guangzhou, Wuhan, Nanjing and Chengdu are a good indicator of which firms are providing first class prime of prime services.

This is because many firms attempt to attract large APAC based companies with vast client books by describing themselves as Prime, yet there is little or no liquidity relationship.

Nobody wants internalization and revenue share, such is the fear of retribution from the government or clients should an IB lose his client money to an overseas firm – highly frowned upon by the Chinese government, whose social stability policies do not take kindly to firms sending the investments of their clients to unvetted overseas firms that then make off with their capital.

Liberal use of the words ‘prime brokerage’ or ‘mulitilateral clearing house and exchange’ are rife among some of the domestic firms that have presence across the nation from Shanghai to Shenzhen.

In other regions, for example Europe, MiFID categorizes financial markets operators across all of the derivatives sector into three specific sectors – the first being a systematic internalizer (SI), whcih is a counterparty that internalizes (b-books) all trades and is not a trading venue, the second being MTFs and OTFs, which are venues, and the third being a regulated marketplace (RM), which is a trading venue.

The main distinction between RMs and MTFs on the one hand and OTFs on the other is that the execution of orders on an OTF is carried out on a discretionary basis.

Whilst MiFID II will require execution to be documented in great detail, the OTC nature of the business still relies on absolute trust between all parties – the broker, client and institutional provider.

This means, quite simply, that sticking to the aforementioned household names, those being Saxo Bank, ISPrime, CMC Markets, Swissquote, Advanced Markets, Invast, and Sucden Financial, brokers will be able to show their clients the complete and comprehensive route of their orders, and how execution was performed.

Recent examples of the consequences of internalization and profit sharing include this year’s bankruptcy of Galant Capital Markets, which has had an enormous knock-on effect, creating deficits for many retail firms and also for other institutional providers that held capital with Galant – that in itself being a red flag, in that liquidity providers do not hold capital with other liquidity providers if they are genuine prime of prime brokers, and, according to substantial research by FinanceFeeds, has brought to the surface several deficiencies in a few firms globally that have purported to offer genuine liquidity via Tier 1 feed aggregation.

There was even an example last week in which a completely unregulated B-book firm with a substantial amount of retail business in China claimed that it is beginning a “prime” service by acquiring a technology provider. It is clear that under no circumstance will a bank extend counterparty credit to that particular firm, hence it can be assumed that the “prime” in this case relates to an attempt to make some of its IBs into brokerages, and then b-book all of their orders.

Whilst banks are beginning to open up to the extension of credit to OTC firms, realizing that the OTC derivatives business is such an efficient and highly organized financial markets sector that it cannot miss out, and certainly cannot develop its own rival, extensive due diligence and caution still prevails.

London, North America, and Australia it is, then…. and always has been.