Girl power! Plus500 admits push by certain shareholders for greater Board diversity

The brokerage mentions the desire of certain shareholders to see greater diversity on the Board, particularly around female representation.

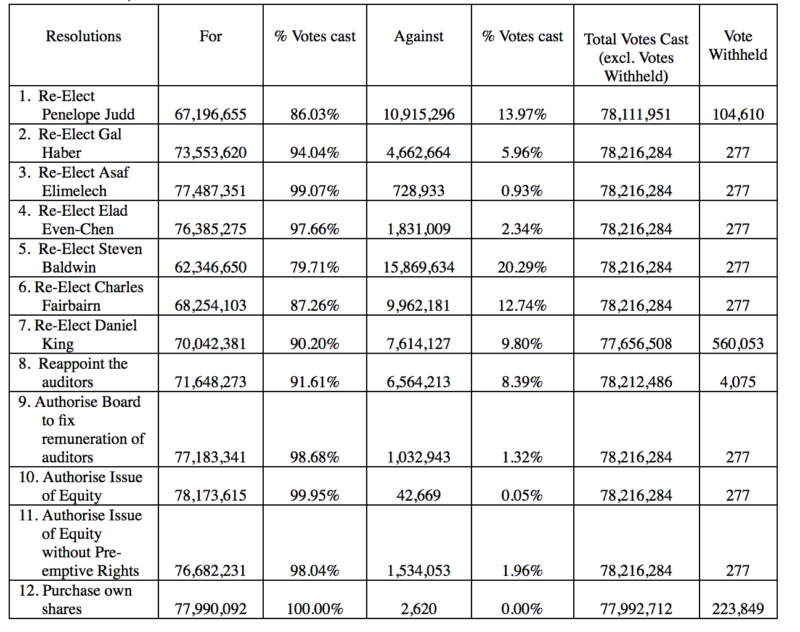

Online trading company Plus500 Ltd (LON:PLUS) has reported the results of the vote on resolutions at its Annual General Meeting held earlier today. All resolutions were duly passed by shareholders by means of a poll vote.

The Board of Plus500 notes that there have been a number of votes (20%) cast against Resolution 5 – “To re-elect Steven Baldwin, who retires by rotation pursuant to Article 42 of the Company’s Articles of Association, as an independent non-executive director”.

The brokerage says that it understands that the size of the vote against resolution 5 is due in part to the desire of certain shareholders to see greater diversity on the Board, particularly around female representation. This is the first time Plus500 mentions of such a stance adopted by its shareholders (at least by some of them).

Plus500 says its Board believes this would be a positive development. With this in mind, while ensuring that future Board members are selected primarily on ability and the balance of skills required, the Company’s nomination committee will seek to increase the female representation, where possible, with any future appointments to the Board.

At 18 June 2019, the issued share capital of the Company was 114,888,377 Ordinary Shares of NIS 0.01 each (including 1,598,609 Ordinary Shares held by the Company as treasury shares).

Over the past several days, Plus500 has actively been purchasing its own shares. Today, the company posted a report announcing that it purchased 20,000 of its ordinary shares of ILS 0.01 each through Liberum Capital Limited. The transactions, which took place on June 17, 2019, are in line with the terms of the share buyback program announced on October 23, 2018.