Global Brokerage, f/k/a FXCM Inc, registers wider stockholders’ deficit in Q3 2019

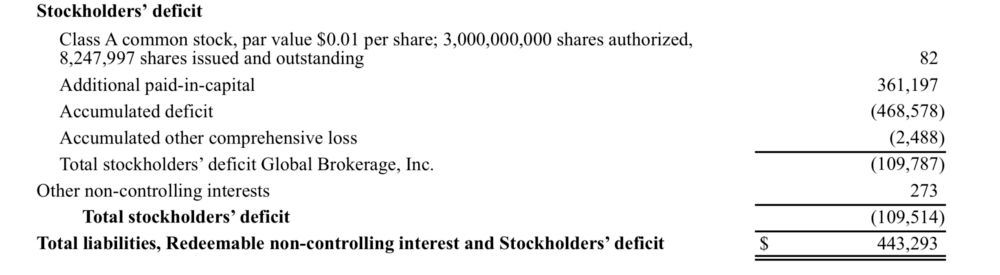

Total stockholders’ deficit stood at $109.5 million at the end of September 2019.

Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc, has earlier today published some data on its website concerning its performance for the three-month period to the end of September 2019, with the report revealing widening shareholders’ deficit.

Let’s note that the company has not been posting any SEC filings since the delisting of its shares from NASDAQ and the launch of its Chapter 11 proceedings. What Global Brokerage posts now are sheets with numbers that cannot be verified.

At the end of September 2019, the total stockholders’ deficit stood at $109.5 million, according to the latest report. This compares to stockholders deficit of $89.8 million reported at the end of the first quarter of 2019 and stockholders’ deficit of $99.9 million at the end of the second quarter of 2019.

The company remains loss-making. In the third quarter of 2019, the net loss amounted to $9.49 million, compared to a net loss of $12.4 million registered in the second quarter of 2019. The loss from continuing operations is $5.86 million.

Total net revenues for the three-month period to end-September 2019 amounted to $31.58 million.