Global Brokerage, formerly known as FXCM Inc, reports stockholders’ deficit of $89.8m for Q1 2019

The company reports net loss of $12.8 million for the three-month period to end-March 2019.

Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc, has published some data on its website concerning its performance for the first three months of 2019. The numbers are pretty dismal which is barely surprising for a company that has emerged from Chapter 11 bankruptcy and has been engulfed in several complex lawsuits, ranging from workplace harassment to derivative shareholder litigation.

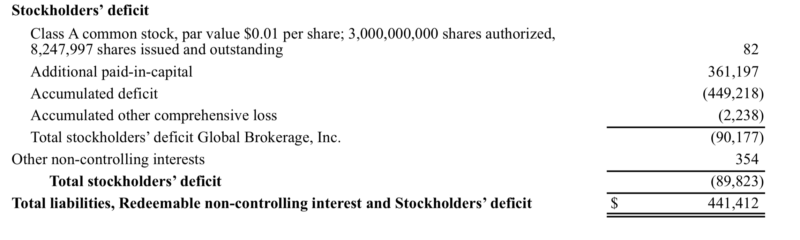

Looking at the data for the first quarter of 2019, let’s note that the stockholders’ deficit has reached $89.8 million. This compares to a deficit of circa $52 million registered a year earlier. Let’s note that the firm did not provide any explanation for the results – the report is just a data sheet (the company is not filing SEC reports now – Ed.)

Further, the net loss for the first quarter of 2019 exceeds $12.8 million, whereas the operating loss exceeds $10.5 million.

Operating expenses for the period amount top $38 million, whereas revenues are approximately $28 million.