Global Brokerage, formerly known as FXCM Inc, sees shareholders’ deficit widen in Q2 2019

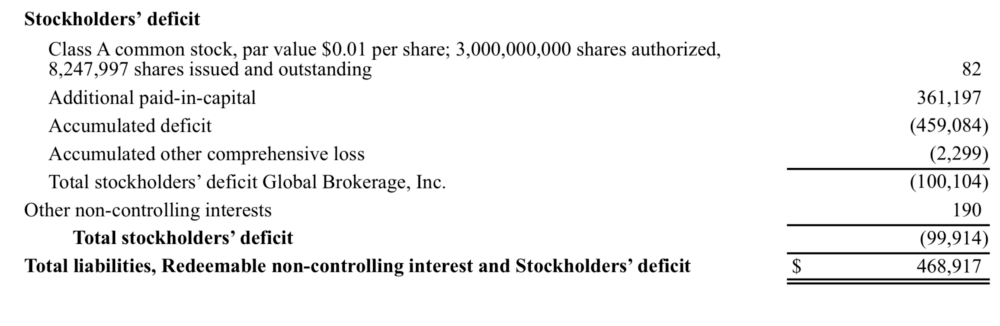

Global Brokerage reports total shareholders’ deficit of $99.9 million at the end of June 2019.

Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc, has published some data on its website concerning its performance for the three-month period to the end of June 2019, with the numbers pointing to widening shareholders’ deficit.

Let’s note that the company has not been posting any SEC filings since its delisting and the launch of its Chapter 11 proceedings. What Global Brokerage posts now are sheets with numbers that cannot be verified.

At the end of June 2019, the total stockholders’ deficit stood at $99.9 million, according to the latest report. This compares to stockholders deficit of $89.8 million reported at the end of the first quarter of 2019.

Global Brokerage continues to incur losses. In the second quarter of 2019, the net loss was approximately $12.4 million, somewhat lower than the $12.8 million loss reported in the first quarter of 2019.

The operating loss for the second quarter of 2019 was $1.97 million whereas the operating expenses amounted to $12 million.

The company provided no details or explanations for the results.