Global Brokerage gets no objections to $2.9m in fees charged by investment banker, counsel, advisors

The biggest chunk of the bill reflects the $2.28 million charged by Perella Weinberg Partners LP, investment banker and financial advisor to the debtor.

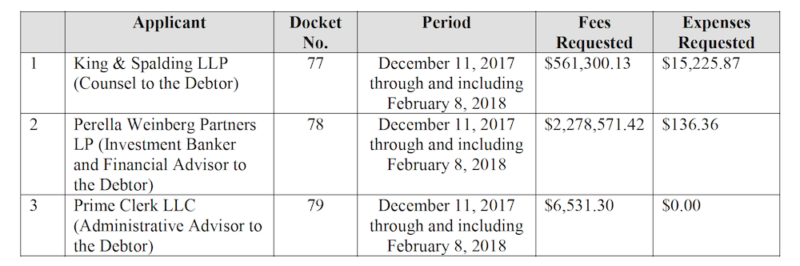

Bankruptcy is not a one-off event, it is a process and it can be rather costly. As FinanceFeeds has earlier reported, Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc, is facing a bill of nearly $3 million reflecting the fees compensation for services provided and reimbursement of expenses incurred by King & Spalding LLP (Counsel to the Debtor), Perella Weinberg Partners LP (Investment Banker and Financial Advisor to the Debtor), and Prime Clerk LLC (Administrative Advisor to the Debtor).

The biggest chunk of the fees reflects the $2.28 million charged by Perella Weinberg Partners LP. PWP says that based on the consummation of the Global Brokerage’s restructuring, PWP is seeking compensation equal to $2,278,571.43 in fees and $136.36 in expenses, which includes $128,571.43 for monthly fees and $2,150,000 for the so-called Restructuring Transaction Fee.

Although Global Brokerage was in bankruptcy for just 59 days, PWP argues that the Effective Date marked “the culmination of months of tireless efforts and rigorous negotiations that resulted in the Plan”.

King & Spalding LLP asks for compensation in the amount of $561,300.13. Let’s not forget K&S and Global Brokerage have been working together before the commencement of the bankruptcy. In the 90-day period prior to the launch of the Chapter 11 case, K&S invoiced Global Brokerage in the amount of $944,451.52 for services rendered to the Debtor in connection with the Debtor’s potential restructuring and the commencement of this chapter 11 case.

Global Brokerage has recently informed K&S on its ability to pay the fees. “The Reorganized Debtor has advised K&S that, as of the date hereof, it currently has approximately $3,122,000 of cash on hand or in deposit, approximately $3,000,000 of which is escrowed and will be used to pay the fees of its professionals. Other than professional fees, all administrative expenses of the Debtor have been paid in full”, K&S said earlier in March.

Responses to the Fee Applications were to be filed and served no later than March 27, 2018. On Thursday, March 29, 2018, the counsel for Global Brokerage certified that no objection or responsive pleading to any Fee Application had been received.

A hearing on the Fee Applications is scheduled for April 3, 2018.