Global Brokerage to respond to stockholders accusations in “Black Swan” case on Nov 17, 2017

Judge Kimba M. Wood has granted the request of KING & SPALDING LLP, representing FXCM Inc, now known as Global Brokerage Inc, and its former head Drew Niv, to file a longer reply brief on November 17th.

Global Brokerage Inc (NASDAQ:GLBR), formerly known as FXCM Inc, is showing firmness in its legal fight against stockholders’ allegations that it abused the “Black Swan” label for the events from January 15, 2015 to cover up its own misconduct.

The case, captioned International Union of Operating Engineers Local No. 478 Pension Fund v. FXCM Inc. et al (1:15-cv-03599), is a securities fraud class action brought on behalf of all purchasers of FXCM common stock between March 17, 2014 and January 20, 2015. When FXCM’s and Drew Niv’s alleged misrepresentations were revealed and the information once concealed from the market was unravelled, the price of FXCM’s securities significantly declined, causing investors’ losses. The Defendants’ conduct is said to have caused an economic loss to the Plaintiff and the Class.

The defendants continue to oppose the allegations. On Wednesday, Judge Kimba M. Wood of the New York Southern District Court granted their request to file a longer than typical reply brief on November 17, 2017. FXCM’s lawyers have asked about such extensions of document length before, as they need to adequately reply to the numerous arguments raised by the plaintiffs.

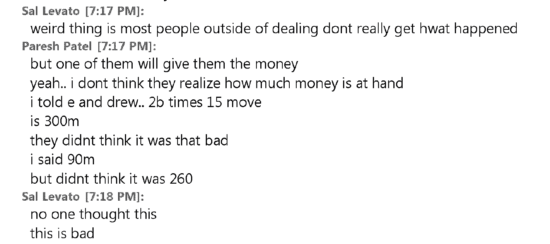

The plaintiffs insist that the January 15, 2015 events were not ones of low-probability and that the risk of loss to FXCM was both known to and discussed by the defendants, as shown by the testimony of operations manager Paresh Patel who raised the issue of increasing margins with Mr Niv as its competitors’ customers flocked to FXCM to take advantage of its more generous (and risky) margin requirements, but Mr Niv declined to do so. One of the confidential witnesses in the case also said that he had issued a similar warning to Mr Niv’s subordinate Brendan Callan, head of FXCM’s European operations.

The plaintiffs also emphasize the importance of the new evidence that has come to light only recently and the events from February 2017, when the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) published proceedings against FXCM and Mr Niv.

Rather than contest the allegations made in these proceedings, defendants chose to settle them, the plaintiffs stress. FXCM and Mr Niv have noted that “the CFTC Consent Order is a ‘no-admit no-deny’ settlement with no evidentiary value,” and that the Court should draw inferences in their favor from the fact that the CFTC did not make certain allegations. The plaintiffs note that they rely on testimony and documents produced by the defendants to the CFTC, instead of the findings in the Consent Order.