Global Brokerage reveals stockholders’ deficit of $52 million

The company has posted a rather mysterious earnings report for the first quarter of 2018, with unexplained and unaudited numbers. There is still no report for 2017.

A rather mysterious report has just appeared on the website of Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc, with numbers for the first quarter of 2018. This is the first time that FinanceFeeds gets to see a company post its earnings for the first three months of 2018 without having reported its results for the preceding three month period and the full year 2017. As we have previously noted, Global Brokerage has not yet posted its 10-K report for 2017 with the Securities and Exchange Commission.

What does the Q1 2018 report contain? A pile of (unaudited) numbers, lacking any explanation or comment.

The credibility of a press release by a company who is in Court over misleading statements to customers and shareholders is also questionable.

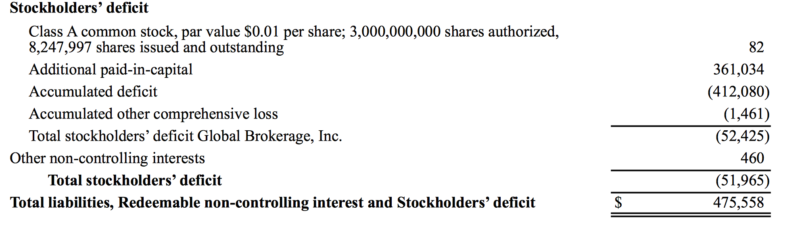

But, nevertheless, let’s take a look at what the document stated. For starters, the total stockholders deficit for Global Brokerage Inc tops $52 million. The accumulated deficit is more than $412 million but this is compensated by additional paid-in-capital of $361 million.

Revenues and income data are not very dismal. Total net revenues for the first three months of 2018 are $45.98 million, whereas the net loss attributable to redeemable non-controlling interest in FXCM Group, LLC is $4.73 million. The operating loss for the period is $2.56 million.

The company is set to hold an earning conference call on Thursday May 17th at 8:30am ET. All questions for the call must be submitted in writing 8 hours prior to the start of the call at [email protected] (yes, of course, they want to filter the questions – Ed.).

Global Brokerage has been under fire over the lack of transparency about its Chapter 11 bankruptcy. The Honorable Michael E. Wiles of the New York Southern Bankruptcy Court has sought to address the issue of the proposed releases by Global Brokerage of its own present and former officers, directors and employees. He voiced his concerns that these are proposed, but no supporting information has been offered as to what the potential claims were, the extent of any investigation of them, why it’s appropriate to do this.

The only ones that got the disclosure statement were the noteholders. No other parties that actually may be affected by the releases were duly informed.

I don’t think that it is sufficient to say, “There’s a bankruptcy, go figure out everything about it and how it will affect you.” I don’t think that’s enough”, the Judge said.

There is nothing astonishing, hence, in the fact that the Judge declined to approve the proposed releases.