Global Brokerage’s stockholder deficit widens to $63.6m in Q2 2018

The company, whose Chapter 11 case was closed days ago, reported a net loss of $16.55 million for the three months to June 30, 2018.

Global Brokerage Inc (OTCMKTS:GLBR), formerly known as FXCM Inc, has earlier today posted a set of metrics for the second quarter of 2018. The company, whose Chapter 11 case was closed several days ago, saw its stockholders’ deficit widen in the three months to June 30, 2018, whereas a net loss was incurred for the period.

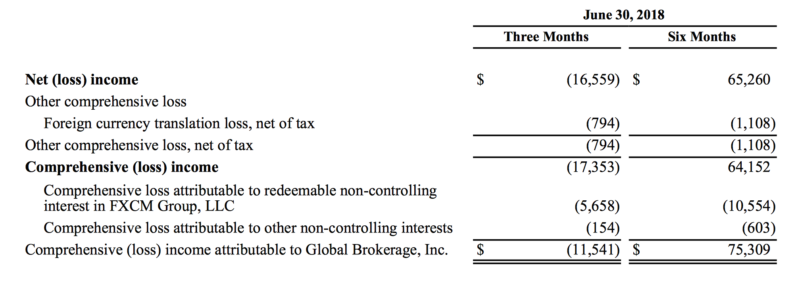

The net loss for the period was $16.55 million, with the comprehensive loss attributable to Global Brokerage, Inc. amounting to $11.5 million and the loss attributable to redeemable non-controlling interest in FXCM Group, LLC being $5.66 million.

The soured fortunes of the company were reflected in the wider stockholders’ deficit. Let’s recall that it topped $52 million in the first quarter of 2018. It stood at $63.6 million at the end of the second quarter of 2018.

The company did not provide any explanation about the numbers. In fact, there have been no SEC filings by Global Brokerage since it filed for bankruptcy in December last year.

Less than a fortnight ago, Judge Michael E. Wiles of the New York Southern Bankruptcy Court signed an Order closing the Chapter 11 case of Global Brokerage Inc. The decision was announced about two months after the broker requested the closure of the case.

In its order, the Court mentioned the objection received from FXCM Inc’s shareholder Brett Kandell. His motion, however, was denied, with the Court saying Mr Kandell may pursue his claims at the Delaware Court where the case against a number of FXCM’s directors over the fairness of the Leucadia deal is pending.

The Order is without prejudice to any parties’ right to seek to re-open the closed Chapter 11 Case for good cause shown. The closing of the case shall not authorize the Reorganized Debtor to destroy any documents, and any obligations of the Reorganized Debtor to preserve documents relevant to pending litigation shall continue pursuant to the applicable preservation orders and applicable law.