GMO Click to launch Virtual Reality app for Forex trading

The launch of the innovative solution for Android is scheduled for January 31, 2017, whereas iOS fans will be able to experience it in February this year.

GMO Click Securities, part of GMO Click Holdings Inc (TYO:7177), has today announced it pushes into a ground-breaking technology that combines Forex trading and virtual reality.

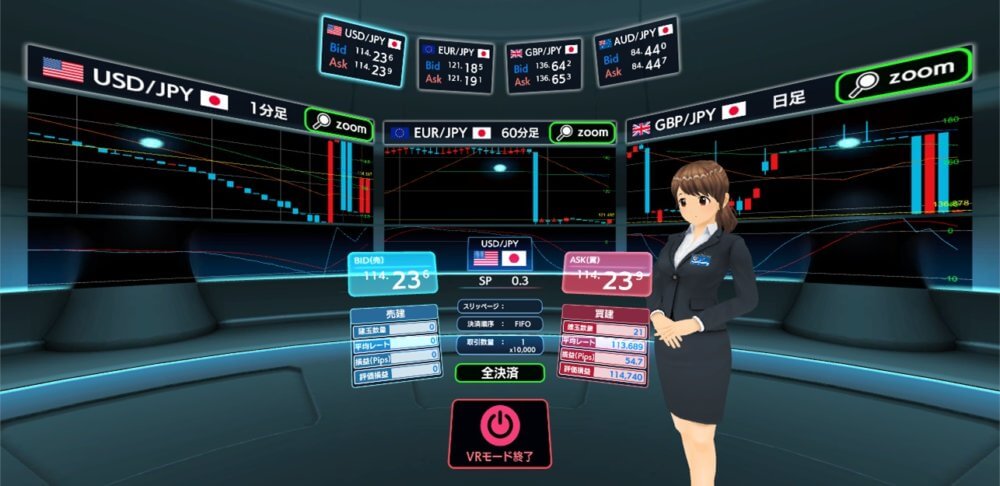

The company is about to launch “GMO-FX VR Trade”, an application for smartphones, which enables users to experience the trading environment like never before.

With the help of a special headset (looks more like goggles – Ed.) traders are able to enter a dealing room, expanded into the virtual space. Navigation is possible via different eye moves and change of focus.

What can traders do? Literally, they can trade with their eyes. They can zoom in and out charts, select currency pairs and and place orders for trading by matching the line of sight.

The launch of the app version for Android devices is scheduled for January 31, 2017, whereas iOS fans will be able to experience this novel technology in early February this year.

The special Milbox goggles necessary for using the app for Android will be offered to 3,000 people based on a lottery. In the meantime, a webpage dedicated to the application provides details about how to control it, a preview, as well as a brief welcome video message.

GMO Click Securities stays true to the mission of providing novel and friendly technology solutions for trading to its clients. FX Neo – its retail FX trading platform, has recently undergone massive upgrade, involving the addition of new instruments and speed improvements.

Another company which is part of the big GMO group of companies – GMO Internet Inc. (TYO:9449), announced earlier this month that it is entering in the virtual currency exchange and trading business with the launch of GMO Wallet Co., Ltd.