GMO’s FX Prime tests AI-based chatbot

The FX broker will start an experiment with an AI-based customer service chatbot on July 30, 2018.

FX Prime, a part of GMO Financial Holdings Inc (TYO:7177), is joining the growing number of companies adopting solutions based on artificial intelligence (AI) in order to enhance their customer support services.

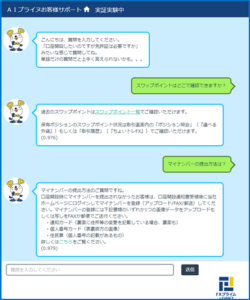

The company has unveiled its plans to launch an AI-based chatbot. The launch is scheduled for September 2018. Before that, however, an experiment with the new solution will be conducted. As of July 30, 2018 (Monday), there will be a dedicated section of FX Prime’s website where those willing to test the chatbot may do so.

The experiment invites traders to submit as many questions as possible to the bot so that it may learn from the feedback. Eventually, the chatbot is set to be able to provide more appropriate answers via the analysis of customers’ questions.

The symbol of the chatbot is the GMO FX Prime mascot (looks like a combination of a rabbit and a panda – Ed.)

Other Japanese FX brokers have been keen to introduce AI-based solutions too. In May this year, for instance, retail Forex broker DMM FX, part of Japanese Internet services provider DMM.com, announced the launch of a chat service using AI. The technology behind the new service is based on IBM Watson.

Japanese retail FX broker Monex Inc, a part of Monex Group, Inc. (TYO:8698), has also taken steps to boost its customer-facing operations by introducing an AI-based chatbot. The solution was initially made available to visitors of Monex’s website sections dedicated to tax returns and annual transaction reports.

AI-based chatbots are particularly useful for responding to trivial enquiries concerning matters like account opening. They are also capable of learning and are available 24/7, whereas human staff may need a break now and then.