GO Markets Review

Australian-headquartered, multi-regulated GO Markets started its operation in 2006 and since then has grown into one of the most trusted brokers in the FX industry. The success of its client-centric approach, quality trading conditions and top-tier licenses resulted in a global expansion into Europe, the Middle East and Asia regions.

GO Markets has a long history of operation as a heavily regulated broker. The company originally started its activity as one of Australia’s first MT4 forex brokers, but then enhanced its offering dramatically. While GO Markets is headquartered in Australia, the company has expanded its proposal through international entities operating in Cyprus, Dubai, Mauritius, Seychelles and other countries. It also has an office in London.

GO Markets focuses on growing its market share behind an excellent choice of trading platforms and a wide range of products. We reviewed GO Markets to determine if its advertised tools provide traders with a competitive edge and check out if the broker deserves your attention.

Pros

- Great choice of trading platforms

- Broad asset selection with different pricing models and diversification opportunities

- Competitive fees compared to the industry peers

- Well-regulated and trusted broker with oversight from top-tier regulators

Cons

- Trading conditions and assets selection may vary depending on your jurisdiction.

Summary

Trading Platforms

GO Markets offers traders a broad range of options to access trading platforms e.g., web, mobile and desktop apps. Besides the industry-standard platforms, GO Markets also offers ideal solutions for beginner traders and those unable to conduct broad-based market analytics.

The platforms range includes the most popular forex trading terminal, Metatrader 4, and its newest version MetaTrader 5. Additionally, you can access third-party applications and add-ons, all available free of charge. GO Markets’ clients can embed services provided by Autochartist, a-Quant and Trading Central.

The truly powerful WebTrader also offers everything you need within a web-based platform that can be accessed directly from any internet browser.

GO Markets’ offering is equipped with a social trading platform, myfxbook . This shows that GO Markets monitors industry trends and commits resources where necessary to deliver the services its client-base demands.

Regulation

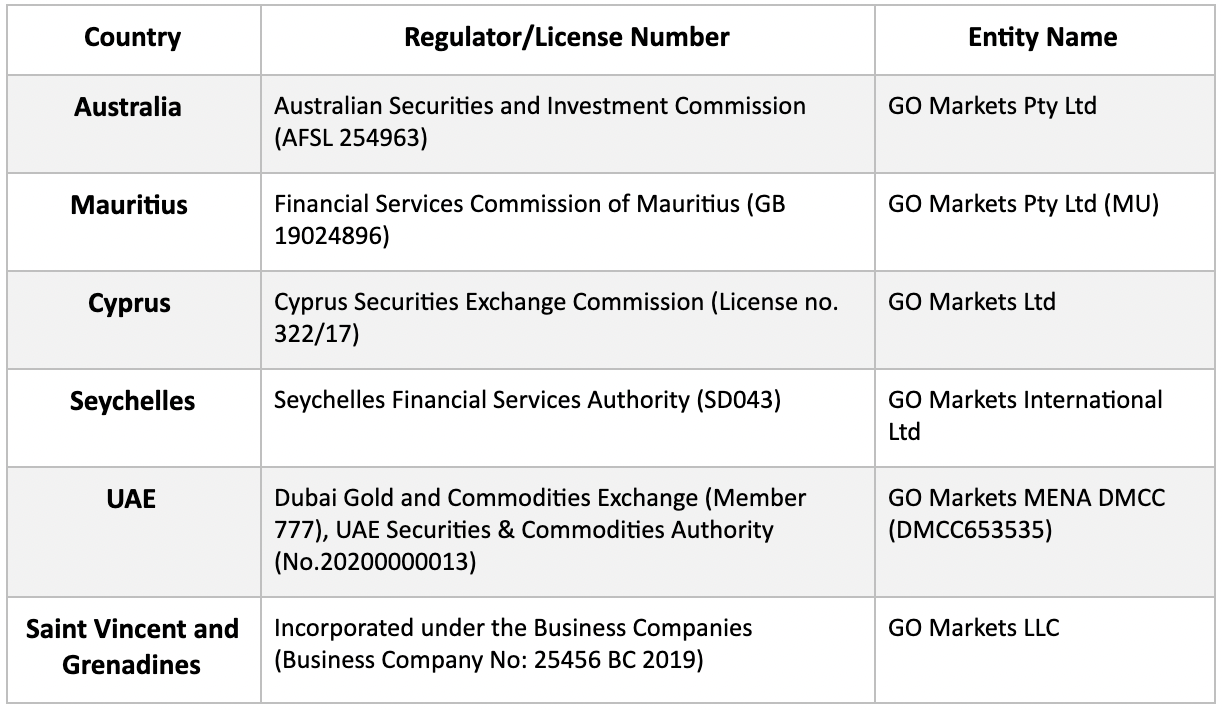

Trading with a regulated broker like GO Markets will limit the potential for fraud and malpractice. GO Markets presents clients with six well-regulated entities.

On top of its outstanding regulatory profile, GO Markets segregates client deposits from company own funds. ASIC entity offers negative balance protection.

It is worth mentioning that the regulatory protection offered by these jurisdictions is significantly different. Most traders, however, will find the regulatory environment in Australia and Cyprus equally satisfactory.

Mauritius, Seychelles and Saint Vincent and the Grenadines is an option for active traders requiring less restrictive trading conditions and higher leverage.

Available Products

GO Markets provides over 600 products, including:

- 50+ forex pairs – major, minor and exotic currency pairs

- 5 commodities – precious metals and crude oil

- 5 cryptocurrencies – Bitcoin, Bitcoin Cash, Ethereum, Ripple & Litecoin

- 15 Indices – FTSE 100, CAC 40, US 500 and ASX 200

- 499 Share CFDs – 200+ ASX shares and 80+ NYSE and NASDAQ shares

Overall, the available product classes/instruments present a balanced mix, offering clients in-depth cross-asset diversification.

Leverage

The leverage at GO Markets depends on the jurisdiction you trade in. Retail traders of entities regulated in Cyprus and Australia get a maximum of 1:30, in line with ESMA and ASIC restrictions.

Option for retail traders to qualify as a ‘Professional Investor’ or ‘Sophisticated Investor’ exists in Cyprus and ASIC entities which offer access to higher leverage ratios, even with heavily regulated entities. But the requirements vary per regulatory stipulations.

Traders through brands incorporated in Saint Vincent and the Grenadines, Seychelles, and Mauritius qualify for maximum leverage of up to 1:500.

Account Types

Overall, GO Markets made it as simple as you may choose between the Standard Account with the spread only basis and GO Plus+* account, which is based on raw spread offering and commission charge per million traded.

Standard Account allows you to trade on tight spreads (as lows as 1.0 pip) with no commission. On the other hand, GO Plus+ presents interbank quotes starting from 0 pips spread, but with a commission of $3.00 per side on the standard lot.

What is also great, no matter your account type is you will get access to:

- 600+ tradeable products

- Any platform of your choice

- Deep liquidity aggregated from 20+ providers

- The minimum deposit in both accounts is an acceptable $200

- Both account types allow you to trade smaller sizes through micro lots

*The GO Plus+ account is only available in select jurisdictions.

Account base currencies

GO Markets added extra flexibility in terms of the account base currencies. The supported range includes 9 different currencies: Australian dollar, US dollar, Euro, British pound, New Zealand dollar, Canadian dollar, Singapore dollar, Swiss franc, Hong Kong dollar.

With such a variety of global currencies available there, you can avoid conversion fees for both deposits and withdrawals while selecting your preferred base rate.

Research and Education

GO Markets offers quality research through trusted third-party solutions with each of them featuring different capabilities. This approach helps free up resources and allows GO Markets to focus on its core business while presenting clients with research tools that are built into their platforms.

Specifically, you will get access to technical analysis performed by Trading Central, and pattern recognition for real-time insights by Autochartist. Another nice touch is the AI-based trading platform, A-QUANT, dedicated to analyzing various markets to produce trading signals based on machine learning prediction algorithms.

GO Markets also shines when it comes to education. The official website features an educational section that delivers a forex trading handbook, MT4 video tutorials, courses, and other essential materials.

Novice traders are very much welcomed at GO Markets. They will get the necessary education support, webinars and learning courses sorted by the level of experience, followed by free demo account access for traders to ply their trade.

Customer Support

The bulk of customer support at GO Markets consists of its client portal, FAQ section and a remote support application. In case the need arises, GO Markets ensures easy access to live chat, E-mail, and phone support. Actually, as we test GO Markets, a multilingual customer support team stands by 24 hours a day, Monday to Friday.

Bonuses and Promotions

Bonuses and promotions at GO Markets are available at select jurisdictions. Where available, GO Markets presents traders with a deposit bonus. Simply deposit into your live account, start trading and you may receive 30% of your deposit back as a trading credit if the eligibility criteria.

Opening an Account

Opening a trading account at GO Markets is as straight as submitting some personal information and a valid email address. But as a regulated broker, account verification at GO Markets is a mandatory final step to comply with AML/KYC regulations. Most traders will satisfy verification requirements by sending copies of documents supporting their ID and residency. I like the simplicity GO Markets deploys here.

Deposits and Withdrawals

GO Markets supports various payment methods that are mostly offered with no charges on the part of the broker. However, the availability and actual cost depending on the jurisdiction and particular method as some funding options may be restricted for some regions and third-party fees might be applicable.

Deposit Options

GO Markets clients have a choice of multiple payment methods, including commonly used ones, such as bank cards and e-wallets. International bank transfers may attract intermediary or conversion fees from either party which are independent of GO Markets.

From the secure online client portal, you can deposit funds throughout:

- Bank/Wire Transfer

- Mastercard & Visa cards

- Fasapay

- Neteller

- Skrill

- BPAY

- Poli

- PayGuru

- PayTrust88

Withdrawals

Withdrawal options at GO Markets are the same as the deposit ones, including bank transfers, e-wallets and credit/ debit cards. With near-instant execution for online solutions, the minimum amount required for withdrawals is dependent upon the payment provider.

Processing times are outlined on the client portal and have been reported as swift and competitive. GO Markets processes withdrawals within 24 hours, but it may take up to 3-5 business days for wire transfers.

Conclusion

Overall, GO Markets’ reputation is right up at the high end of the industry. It has extensive experience, a lengthy track record and good regulatory standing in Asia, Europe and other regions worldwide. Therefore, it is safe to trade with GO Markets.

GO Markets presents a great selection between trading terminals, including industry-leading platforms and a social trading network, which are available for all account types.

The product classes offered for trading are diverse and sufficient to cover the majority of retail and professional traders. Advanced traders will get tailored proposals as well.

Fees are reasonably competitive. Trading conditions are great, and the company’s well-developed education section is organized in an impressive way.

Leverage ratios depend on the respective regulatory jurisdiction of the GO Markets subsidiary, ranging between 1:30 to 1:500 for retail traders.

The support center is quite responsive and speaks multiple languages including English, Vietnamese, Thai, Indonesian, Chinese, Arabic, Portuguese and Spanish.