Gold Spirals into 7th Day of Losses – Guest analysis

Dan Blystone of Scandinavian Capital Markets looks at the 7 days of losses in the Gold markets

By Dan Blystone, Senior Market Analyst, Scandinavian Capital Markets. With 22 years of experience, Dan gained insight to the markets working at Altea Trading, ABN AMRO and Infinity Futures in Chicago. He is the founder of TradersLog and the Chicago Traders Group. Find out more about Dan by clicking here.

Gold prices entered a seventh consecutive day of losses on Tuesday, as investors hoarded cash amid the deepening economic crisis caused by the coronavirus pandemic. Although gold typically benefits from its safe haven status in times of unrest, investors have been selling in order to meet margin calls and reduce their risk exposure by holding cash.

On Monday the Dow Jones Industrial Average plummeted by almost 3,000 points, marking its largest point drop in history. The selloff came on the heels of the Federal Reserve’s surprise move on Sunday to cut interest rates to near zero, the Fed’s second emergency rate cut in less than two weeks.

According to Johns Hopkins University, over 182,400 people have been infected by the coronavirus and over 7,100 have lost their lives. For the first time, the number of deaths outside China have now surpassed those inside. Multiple countries have announced emergency border closures, restricted movement and banned gatherings in an attempt to slow the spread of the pandemic.

The safe haven Swiss franc and Japanese yen traded higher on Monday, while risk sensitive currencies such as the Australian dollar, New Zealand dollar and Canadian dollar fell to multi-year lows. Bitcoin continued its plunge downward on Monday, further dispelling any notion of it serving as a safe haven.

US stock index futures pointed to a higher open on Tuesday after US President Donald Trump tweeted: “The United States will be powerfully supporting those industries, like Airlines and others, that are particularly affected by the Chinese Virus. We will be stronger than ever before!”

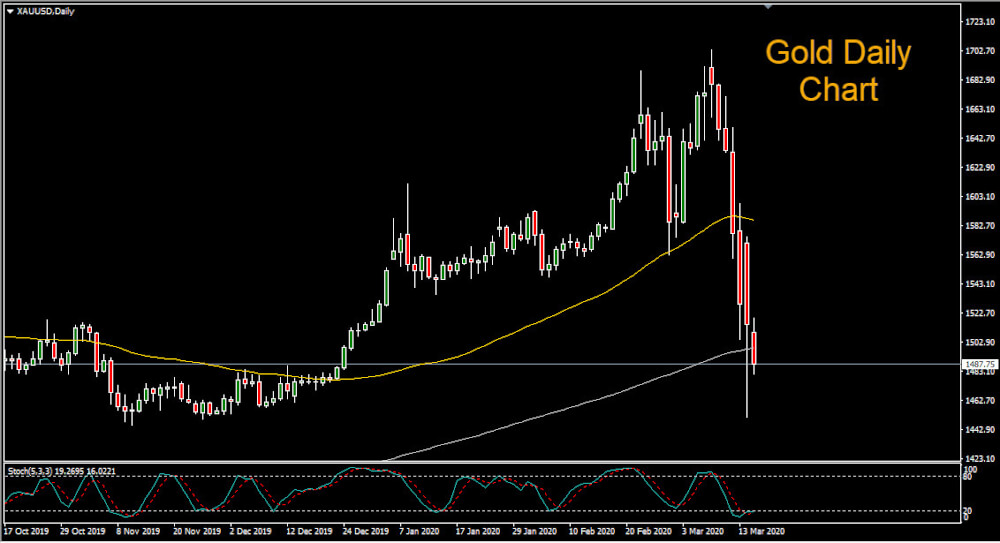

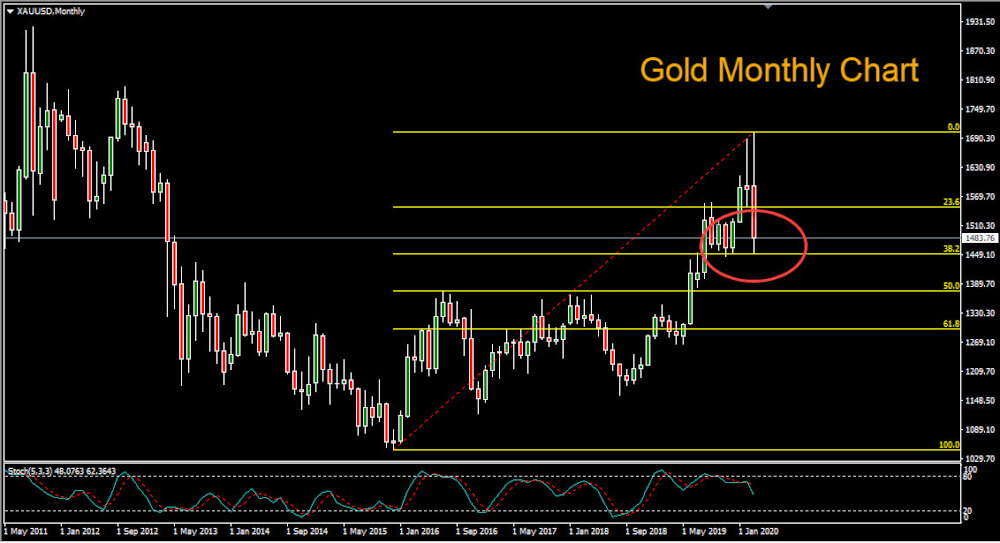

Looking at the gold monthly chart we can see that price fell to the 38% retracement level of the up move that began in December of 2015. Gold managed to close above the 200-period moving average on the daily chart on Monday, but a close below it on Tuesday would further energize the bears.