Greenback Bid at the End of Devastating Week – Guest Editorial

Thursday’s selloff on Wall Street marked its largest losses since the October 1987 crash says Dan Blystone

By Dan Blystone, Senior Market Analyst, Scandinavian Capital Markets. With 22 years of experience, Dan gained insight to the markets working at Altea Trading, ABN AMRO and Infinity Futures in Chicago. He is the founder of TradersLog and the Chicago Traders Group. Find out more about Dan by clicking here.

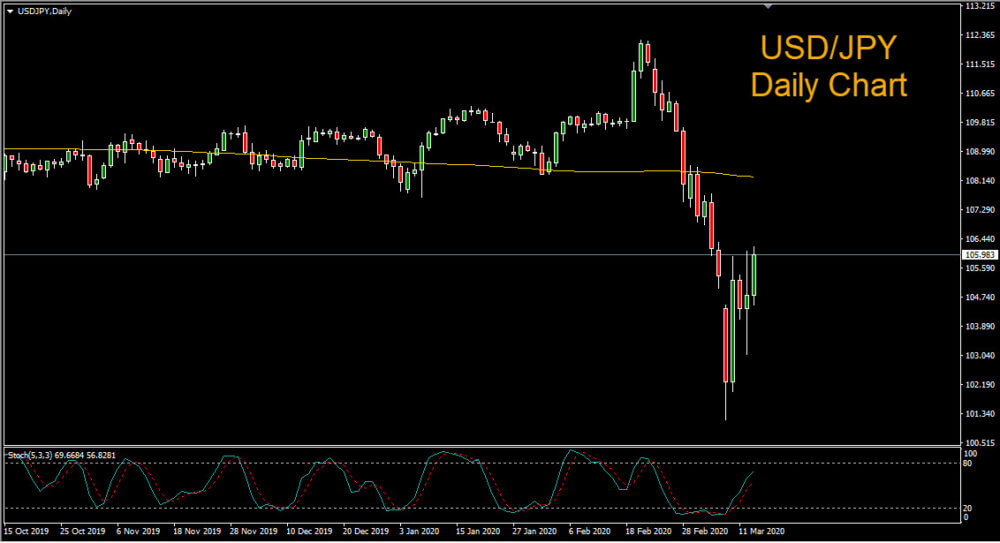

The US dollar surged against major rivals on Friday, as investors sought refuge in the world’s most liquid currency. The greenback reached its highest levels in a week against the Japanese yen and its highest levels since October against the British pound.

Earlier this week, the euro rallied to its highest levels in over a year against the dollar. However, the single currency weakened on Thursday after the European Central Bank (ECB) announced more stimulus to fight the economic impact of the coronavirus but disappointed markets by refraining from lowering interest rates. ECB president Christine Lagarde was criticised after refusing to assume the ‘whatever it takes’ stance of her predecessor Mario Draghi.

On Thursday, the Federal Reserve Bank of New York took steps to inject more than $1.5 trillion into short term funding markets as stocks plunged due to fears over the coronavirus. Analysts anticipate that the Fed will slash interest rates further at the conclusion of the March 18th meeting. The CME Fedwatch tool currently indicates a 55.7% chance of a 100 basis point cut, to a target range of between 0 and 0.25%. Earlier in March, the Fed made an emergency 50 basis point cut in its benchmark funds rate to address the coronavirus threat.

Meanwhile, risk-sensitive currencies such as the Australian dollar and the Canadian dollar staged a modest bounce from multi-year lows in early trading on Friday. On Monday, oil-linked currencies such as the Canadian dollar, Mexican peso and Russian ruble were crushed after Saudi Arabia pledged to aggressively boost production and cut prices.

Asian markets fell sharply on Friday, but European stocks and US stock index futures are trading higher at the time of this writing. Thursday’s selloff on Wall Street marked its largest losses since the October 1987 crash.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.