What are the best-performing FTSE 100 stocks of 2020? – Guest Editorial

In this article, IG Group takes a close look at the five top-performing shares from the FTSE 100 in 2020 so far.

Will Hall-Smith is a senior financial writer for IG Group, a FTSE 250 trading and investments provider. His research and publications cover a range of asset classes, risk management and the effects of politics and economics on markets. Will also has a particular interest in the future of trading technology.

The FTSE 100 has been very volatile throughout 2020 and is down overall from the start of the year. But some of its constituents have increased in value, meaning that investors could have outperformed the index by picking the right stocks. Here we take a look at the returns of the top five FTSE 100 stocks of 2020 so far.

If you’d like to see how much you could have made from FTSE 100 stocks over longer timeframes – ranging from one to ten years – you can use IG Group’s Hindsight Investments tool.

What are the best-performing FTSE 100 stocks of 2020 so far?

- Persimmon (PSN) – 18.78% returns

- SSE (SSE) – 16.99% returns

- BAE Systems (BAES) – 16.18% returns

- Taylor Wimpey (TW) – 15.77% returns

- Polymetal International (POLYP) – 13.78% returns

Notes: This information was correct at 2.15pm (UK time) on 24 February 2020. Total returns include dividend payments, if made, and assume that these were reinvested. Just Eat Takeaway was excluded from the analysis because it was formed in a merger part way through 2020. Past performance is no guarantee of future results.

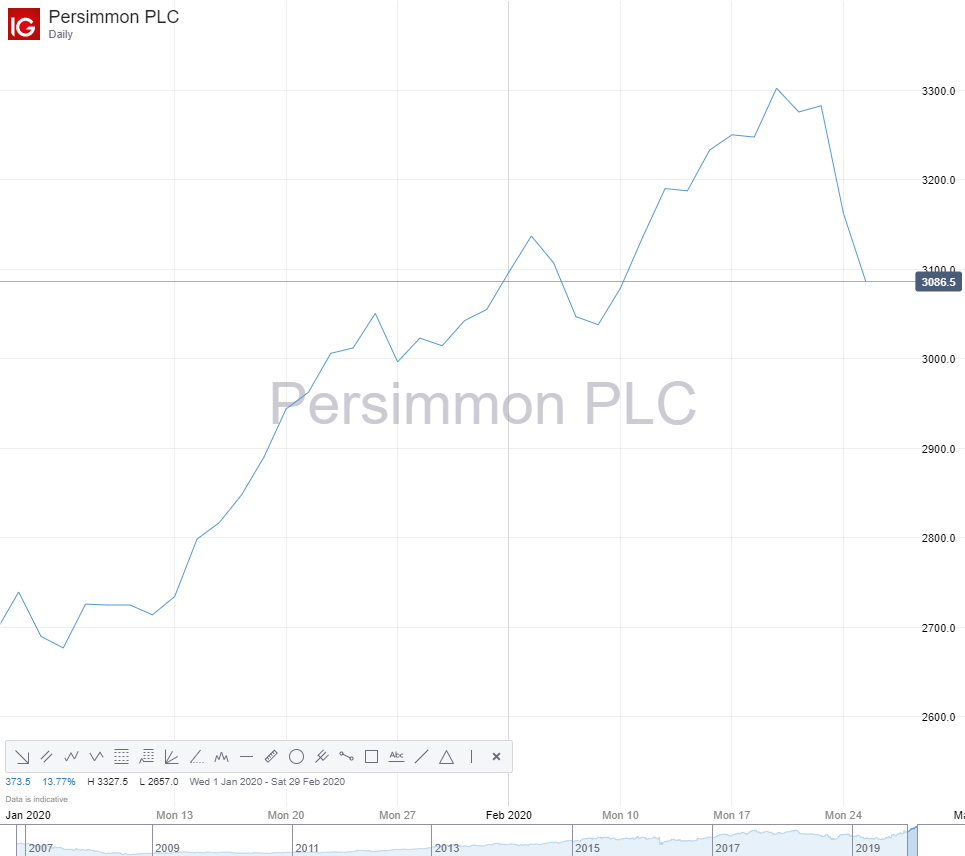

Persimmon (PSN) – 18.78%

Persimmon – a major UK house builder – has provided shareholders with total returns of 18.78% in the year to date, while its share price has risen by nearly 80% over the last six months. This rise can be attributed to a recent focus on improving quality, following years of complaints over building standards, as well as a greater degree of political certainty post-Brexit, which has renewed interest in the UK housing market.

In the years ahead, Persimmon is planning to develop at least 100,000 plots,* and will launch a new roof-tile production facility to reduce costs. As a result, the outlook for the company looks positive. However, any future share price rise will depend on its ability to improve customer satisfaction and navigate an increasingly competitive landscape, especially since it sold fewer houses in 2019 than it did in the previous year.

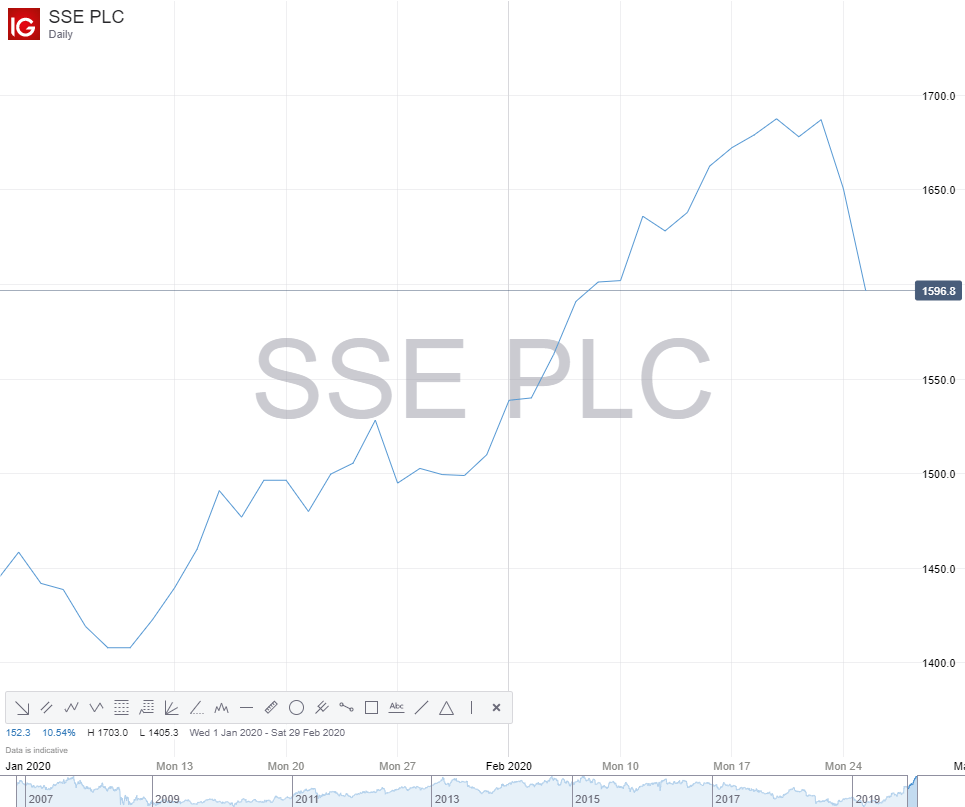

2: SSE (SSE) – 16.99%

SSE is a low-carbon energy company with operations across the UK and Ireland. Its shareholders have seen returns of 16.99% so far in 2020, in part due to the sale of its retail unit to OVO Energy in January. This, it is hoped, will enable SSE to focus on power generation and network operation – its core businesses.

The company’s 2019 interim results look positive, with rising demand for renewables leading to a 15% boost for its adjusted profit before tax and a 10% increase in its earnings per share (EPS).* However, it’s worth noting that the firm’s profitability could be at risk if regulations were to change in the future, while it is also likely to face increased competition in the renewables space.

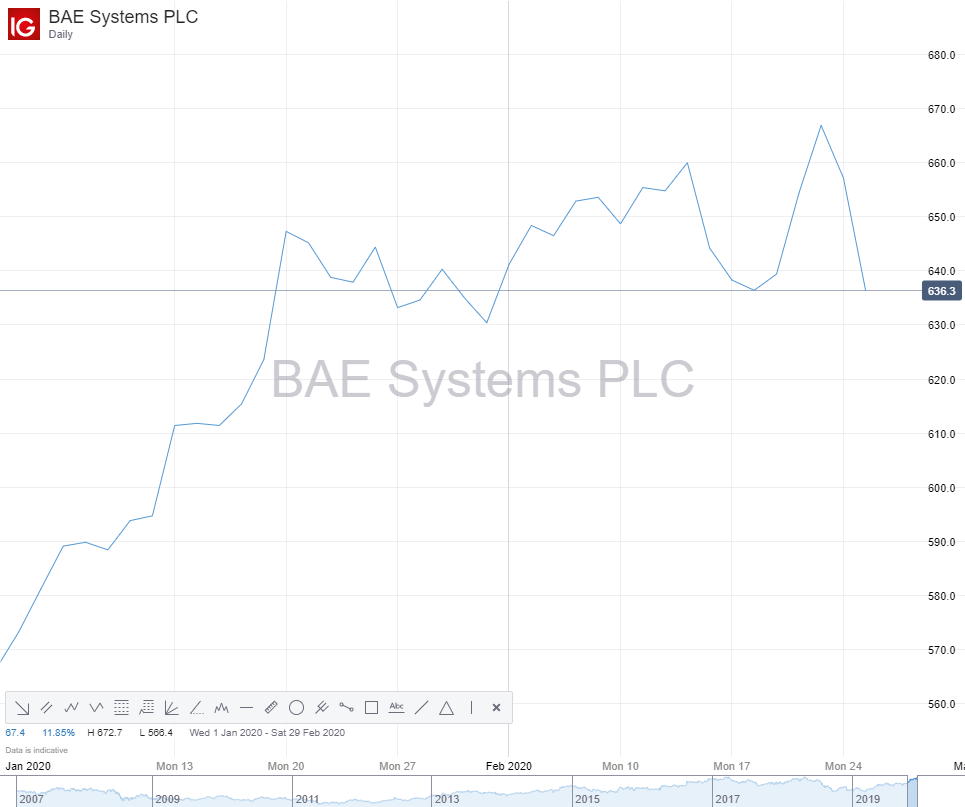

3: BAE Systems (BAES) – 16.18%

BAE Systems is one of the largest global defence companies, with operations across 40 countries and market-leading positions in the US, UK, Saudi Arabia and Australia.* Its shareholders have seen returns of 16.18% so far this year, on the back of a strong financial performance in 2019.

Its profits grew by 7% to £18.3 billion, with profits reaching £1.9 billion – a £294 million increase on 2018.* The outlook for BAE Systems in 2020 also looks to be positive, with a strong order book. However, potential investors should be aware that the BAE Systems share price is often influenced by geopolitics, with tension tending to increase defence spending. As a result, any improvements in the geopolitical situation could see its share price fall.

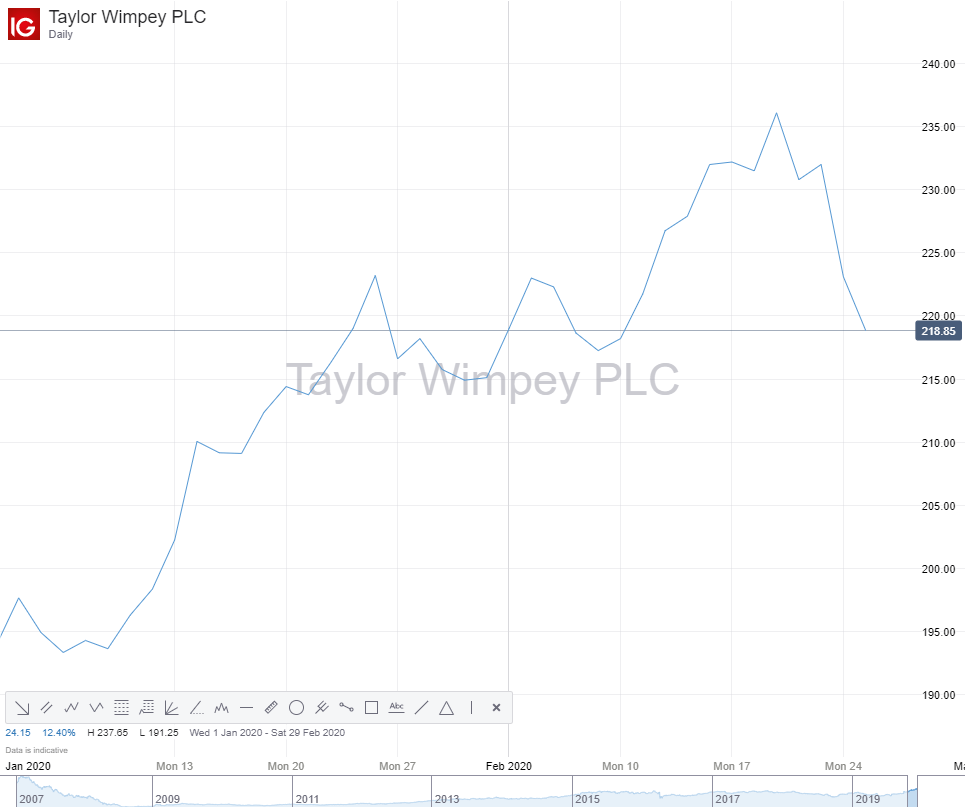

4: Taylor Wimpey (TW) – 15.77%

Taylor Wimpey has achieved shareholder returns of 15.77% so far in 2020, making it the FTSE 100’s fourth best-performing stock of the year to date. The company is a housebuilder with operations in 24 regions of the UK, as well as popular holiday destinations in Spain. Like Persimmon, it has benefited from a post-Brexit bounce in the housing market and a ‘customer-centric’ strategy.*

In 2019, the company increased completed house sales by around 5% in the UK – despite the economic uncertainty – and achieved record orders of £2.2 billion.* These improvements set it up well for a strong performance in 2020. However, one area of concern is a substantial drop in profitability, with its margins falling from 21.6% in 2018 to 19.6% in 2019.* As a result, any future rise in its share price is likely to depend on further increases in volume or a reduction in costs.

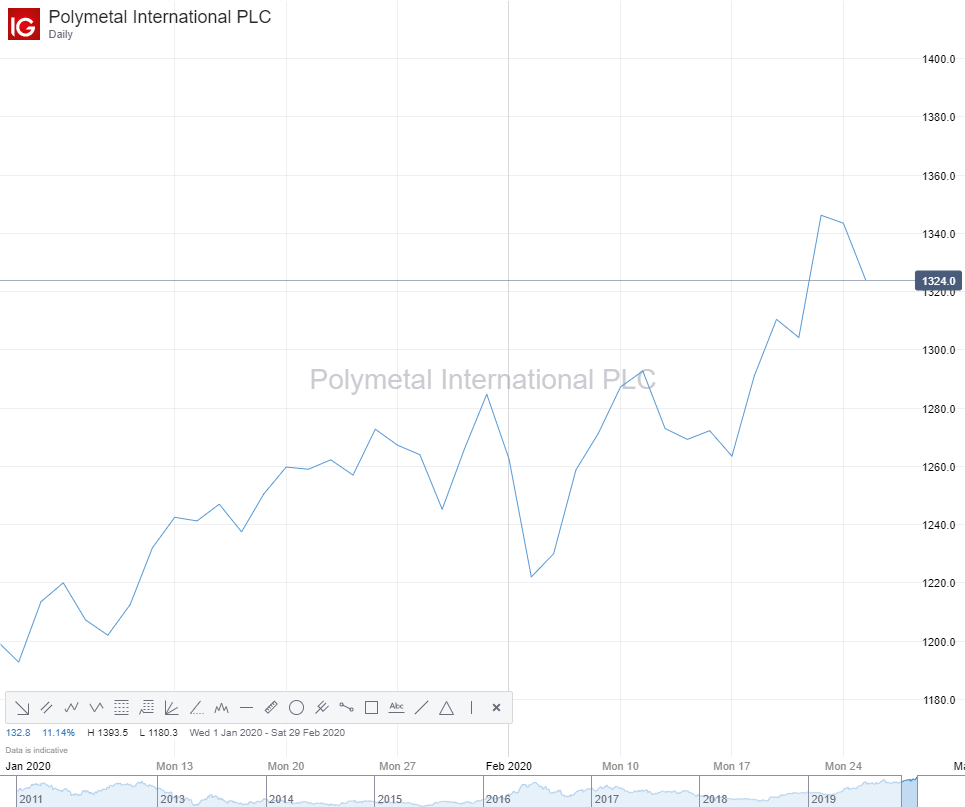

5: Polymetal International (POLYP) – 13.78%

Polymetal International is a gold and silver mining firm, with nine operational mines across Russia and Kazakhstan. The company has provided shareholders with returns of 13.78% in the year to date, on the back of rising gold prices and increased production volumes.

However, while its revenues increased by 19% to $2.2 billion in 2019,* investors should be aware that its shares are very vulnerable to changes in precious metal pricing. Its future growth is therefore likely to depend on its ability to extract additional value from its existing mines and those under development.

What next for the best-performing FTSE 100 stocks of 2020?

What happens next for the best-performing FTSE 100 stocks of 2020 remains to be seen, but it is clear that short-term trends played a role in the growth of some of these shares. Investors looking to take positions may therefore want to consider the performance of FTSE 100 stocks over a more significant timeframe, in order to get a sense of the trends that are driving long-term growth.

One way to do this is to use IG Group’s Hindsight Investments tool, which calculates past returns on your behalf. All you need to do is select a FTSE 100 stock, the amount of investment capital and a timeframe, and the calculator will do the rest. The site also highlights the top five FTSE 100 stocks of the last decade – one of which would have given you a total return of 3238% over ten years.

You can view the Hindsight Investments research here.

* Sources:

- Persimmon (2019)

- SSE (2020)

- BAE Systems (2020)

- BAE Systems (2020)

- Taylor Wimpey (2020)

- Taylor Wimpey (2020)

- Polymetal International (2020)

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.