Has gambling replaced old-style retail FX? We investigate Playtech’s stellar Q3 figures

As retail FX becomes more sophisticated, it is of interest that companies which operate in the gaming industry are rocketing forward in terms of revenues. Going back five years, small retail FX firms were not considered to be part of the mainstream currency trading industry, and were regarded by the larger firms as one step […]

As retail FX becomes more sophisticated, it is of interest that companies which operate in the gaming industry are rocketing forward in terms of revenues.

Going back five years, small retail FX firms were not considered to be part of the mainstream currency trading industry, and were regarded by the larger firms as one step away from gaming firms, operating their business on a profit and loss model through a closed system with the pre-bridge MetaTrader 4 front end providing customers with the opportunity to do battle with the dealing room, and only as far as that.

Indeed, the target audience for such firms was far less investors as it was customers of online casinos.

Since the evolution of retail FX onto the open market and its continual emulation of the institutional sector, with access to genuine Tier 1 liquidity now commonplace, the fact that gaming firms are making exponential increases in revenue is likely more than a coincidence.

Are gambling companies prospering by mopping clients of old-school P&L retail FX firms?

Gambling software development company Playtech PLC (LON:PTEC) the evolution of retail FX firms could well have been an instrumental factor in assisting the fortunes of the company.

Whilst Playtech is one of the most prominent firms in the gambling arena, its business interests are closely linked with the retail FX business. The company is part of Teddy Sagi’s online trading empire, and since its £550 million flotation on the London Stock Exchange in 2006, has shown a great deal of interest in merger and acquisition activity with FX companies, the most recent being its acquisition of Plus500 in June this year for $699 million.

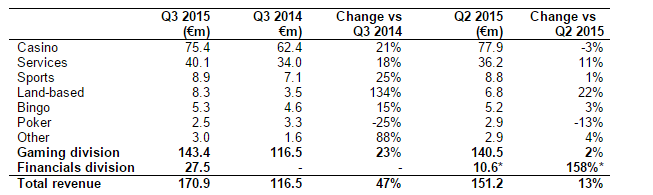

Today, Playtech announced a remarkable 47% increase in total revenues in its Q3 trading update, when compared to the third quarter of 2014.

Whilst this increase in revenues was across the board, the firm’s Financials Division recorded a vast 36% growth compared to the same period in 2014, and its Gaming Division recorded a growth from new and existing business of 73% from regulated markets.

This vast increase could well be an indicator that former customers of retail FX firms are seeking online gambling, whilst retail FX firms are increasingly attracting astute investors as clients.

As an example, revenues from land-based terminals grew 22% in the second quarter of this year compared to the second quarter of 2014, sdanding at 6.8 million Euros or the quarter, whereas in the third quarter, this figure rocketed to 8.3 million Euros, a staggering 134% increase over last year.

When bearing in mind that in certain jurisdictions in which gambling is not only very popular, but part of the culture, such as Britain, Australia and New Zealand, it could be that stricter controls on retail FX business by regulators such as ASIC in Australia, which has spent the past year being extremely selective as to the processing of new AFS licenses for new FX companies, and actively clamping down on retail FX activity in the region has generated greater interest in online gambling.

The continuing interest in partnering with betting firms and offering land-based terminals for gaming by binary options software providers rather than the previous direction of partnering with retail FX firms via shared wallet solutions also adds weight to the notion that gambling has partially taken the place of the original retail FX business.