Have you received one of these from LMSwiss? Trader beware!

Have you left your details with a broker in the past? If so, your name and contact information is most certainly in circulation within the many lead lists distributed between brokerages. I receive quite a few unsolicited (spam) emails a month to my personal email address, and usually think nothing more of it unless I receive […]

Have you left your details with a broker in the past? If so, your name and contact information is most certainly in circulation within the many lead lists distributed between brokerages.

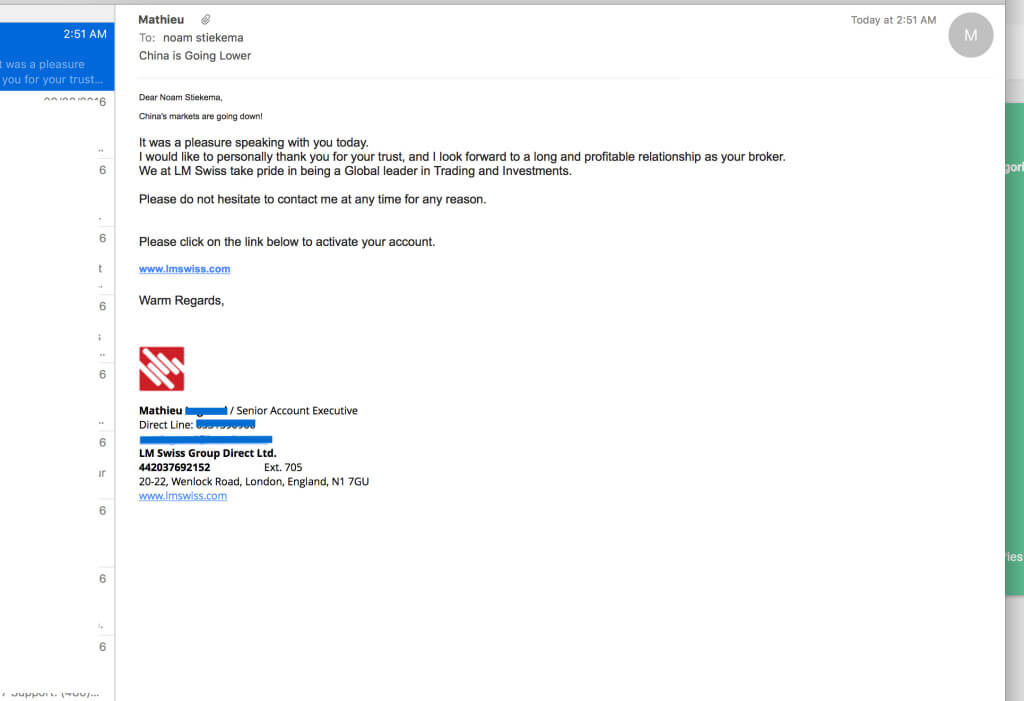

I receive quite a few unsolicited (spam) emails a month to my personal email address, and usually think nothing more of it unless I receive emails such as this one from the team at LMSwiss.

Note that I never signed up with LMSwiss, nor did I receive a call from any representative (although an awkward phone call would have been enjoyable).

Unsolicited email from LMSwiss- thanks for the “China is Going Lower” [sic] heads up.

The unsolicited nature of the email, the formatting (copy paste job), the “chat” that never happened and the intent to mislead potential customers with the name, supposed location in the UK and no license; topped my list as unacceptable.

A further visit to their website (which indeed is what the email was intending to achieve), shows just what I expected; another offshore broker, playing on the Swiss good name, registered in UK (not licensed), and operating as an offshore entity on a remote island, whilst the content of the email provided no further information.

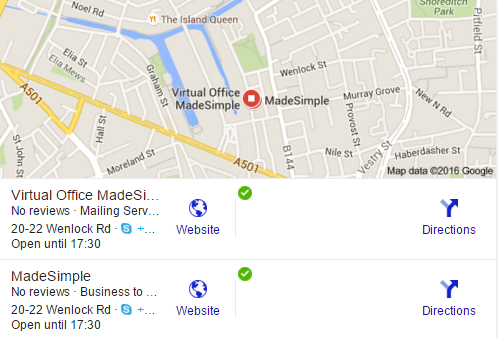

Indeed, the address in London which is provided at the foot of the email, is home to a virtual office provider, as detailed here:

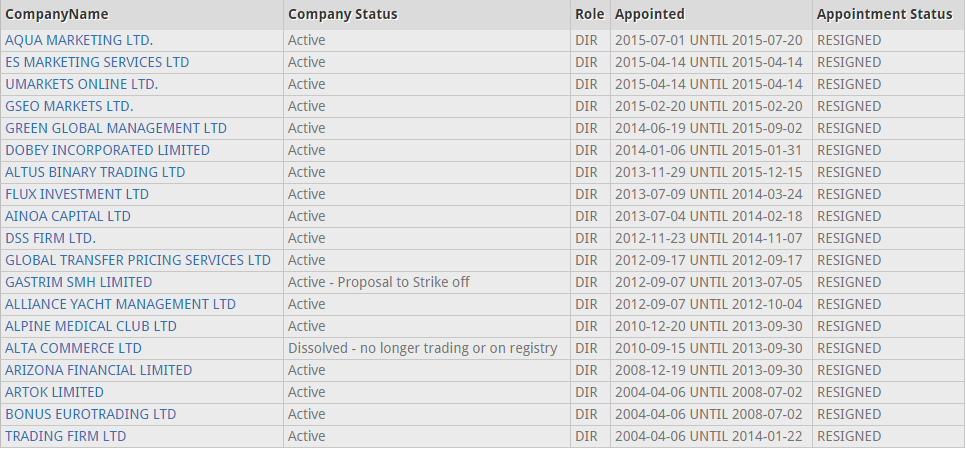

The directors of the company are listed according to this link from the UK registry of companies and directors.

One of the directors, Genevieve Odette Rona Magnan lists herself as residing in Belize and working at OneMillion Ltd, and DexterFX, both of which are expert advisor (EA) sites.

The other director, Vanessa Marie-Antoine Payet, has a litany of defunct directorships to her name, largely within the unregulated binary options sector, as depicted by this chart here from the British government’s records which relate to active and inactive directorships.

A case of another “overnighter” out there trying to intentionally mislead investors by taking shortcuts, and to that extent, FinanceFeeds believes that this company has connections to other, more prominent entities and would welcome any information, anonymously or otherwise, on this matter.

Caveat emptor!