Having a ball with FXPRIMUS

Standing out from the crowd is most certainly one way of getting noticed. Today at the iFXEXPO Asia 2016, which is hosted by ConversionPros and Finance Magnates, FXPRIMUS literally set the ball in motion by inviting potential retail customers and commercial partners into what could best be described as a giant pool table adorned with […]

Standing out from the crowd is most certainly one way of getting noticed.

Today at the iFXEXPO Asia 2016, which is hosted by ConversionPros and Finance Magnates, FXPRIMUS literally set the ball in motion by inviting potential retail customers and commercial partners into what could best be described as a giant pool table adorned with balls the size of those which would be more commonplace at a bowling alley.

Marketing and brand positioning has been a focus for FXPRIMUS this year, and the firm’s somewhat innovative and unorthodox approach is gaining attention.

Aside from establishing a new television studio in Cyprus this year (watch this space!) and onboarding some key senior executives with backgrounds in FX technology as well as the actual currency markets, the firm is venturing from the conventional.

Speaking today to Andrew Saks-McLeod, FXPRIMUS Head of Marketing Laoura Salveta explained “Capturing the attention of new clients and engaging them is vital these days, and providing a unique feel to the company is a critical part of the firm’s ethos.”

This most certainly applies to the approach to providing a market view, as denoted in today’s workshop, led by Marshall Gittler.

Marshall Gittler lambasts the forecasting system of the Fed

In a very upbeat, blustery and to the point workshop on market related issues, FXPRIMUS Market Analyst Marshall Gittler was keen to make his disdain for the corporate predictions of the public sector, the large institutions and the officials.

“The market is better at forecasting what the Fed will do than the Fed is” he said.

“We have not made much progress in forecasting since Roman times. Back then, they used to forecast by cutting open a sheep and looking at how its intestines were” – Marshall Gittler.

“The people with over 80 PhDs basically just look at the previous year and say that this year will be the same as last year” exclaimed Mr. Gittler.

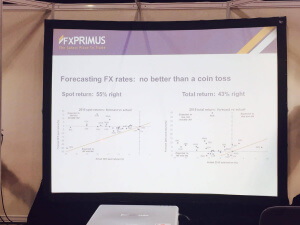

Giving an example, he explained “I took the average forecast from Bloomberg and compared it to a coin toss. The vast majority of forecasters were very far wide of the mark in their estimations across all returns on spot FX transactions during 2015.”

“The market was way off, forecasting the US dollar to be worth 1.06 at the beginning of the year, and the average for December was 1.09 against the Euro” Mr. Gittler detailed.

“This made absolutely no sense to use that method of assuming that the Euro price against the Dollar would be the same as it was across the entire previous year because the Euro Dollar is very rarely stable. The median is about 7% per year but most market forecasters guess and have no means of measuring the future values” he said.

“OK, the Swiss National Bank event and the volatility it caused could not have been predicted, however the Dollar/Yen fell 2% every day over a sustained period in 1998, which is unbelievable for a country with the fiscal power of Japan, so how did this happen? According to many pundits it is down to Russia defaulting on its bonds.”

“You may ask yourself what the heck has Russia’s defaulting on its bonds have to do with the price of the value of the Dollar against the Yen?” asked Mr. Gittler.

“Many hedge funds had borrowed yen to fund positions in Russian bonds (the yen carry trade — borrow money at a low interest rate and invest it at a high interest rate). Borrowing the yen and converting it into RUB was one of the main things that weakened the yen (pushed USD/JPY higher). When those bonds suddenly because worthless, the hedge funds all rushed to repay the yen loans, which meant converting money back into yen from dollars or rubles or whatever. That sent the yen soaring (USD/JPY collapsing) for a week in September 1998.”

Why so hard?

“What would appear relatively easy, therefore, is absolutely not and there are some simple reasons for it” explained Mr. Gittler.

“One reason is that some people are overconfident, and they start to believe that they understood the past and this fosters inability to predict the future.”

“There is also a confirmation bias, where people believe in something, they are likely to believe arguments that appear to support it” he continued.

“Cognitive dissonance is also a factor, in that when people do not believe in something, they are likely to disregard arguments that contradict it.”

In short, many employees tasked with generating market predictions fear of saying “excuse me boss, youre wrong” because that could mean waving goodbye to their bonus!” concluded Mr. Gittler.