Hedge fund 683 Capital Partners targets FXCM in civil lawsuit

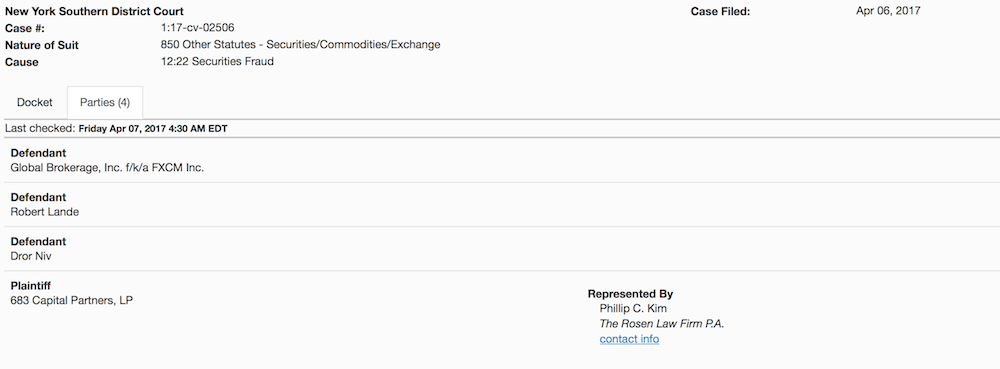

Representing the hedge fund at the New York Souther District Court is Phillip Kim from the Rosen Law Firm.

The number of plaintiffs joining legal actions against FXCM Inc, now known under its new name Global Brokerage Inc (NASDAQ:GLBR), over the latest US regulatory revelations into the business practices and claims of the broker, is growing.

On April 6, 2017, another case was brought against the brokerage. The plaintiff is hedge fund 683 Capital Partners LP, which is represented by Phillip C. Kim of the Rosen Law Firm. Data from the New York Southern District Court shows that a Complaint, a Civil Cover Sheet and Requests for Issuance of Summons with regards to the start of a civil lawsuit against the brokerage have been filed with the court.

Although details are not available to the public, it is known that the plaintiff is accusing the defendants of securities fraud. The defendants include Global Brokerage Inc (f/k/a FXCM Inc), Robert Lande and Dror Niv. The case number is 1:17-cv-02506.

To find out more about 683 Capital Partners LP, we have to look at information from the end of March 2017 filed with the United States Securities and Exchange Commission (SEC). It shows that 683 Capital Management LLC, which became an SEC-registered investment adviser on February 9, 2012, currently provides discretionary investment advisory services to one client, 683 Capital Partners, LP.

683 Capital Partners, LP is a private investment fund formed as a Delaware limited partnership. The current gross asset value of the fund at the end of March 2017 is put at $853,744,010.

Of course, you must be interested in the fund’s holding in FXCM. The latest data FinanceFeeds has uncovered on the topic comes from a 13F filing with the SEC. Please, treat all 13F filings with a notch of skepticism – they are problematic in terms of credibility thanks to Madoff, unfortunately. And yet, let’s examine the data – the latest such filing submitted by 683 Capital Management LLC is for the quarter to December 31, 2016. It shows a holding in FXCM indeed. The principal amount is 17,000,000 shares, whereas the value is $9,180×1,000.

In its annual report for 2016, FXCM has stated that it intends to “vigorously defend” against the claims asserted in the legal actions brought against it. Back then, Global Brokerage mentioned three securities class action lawsuits filed against it, Dror Niv, and Robert Lande in the U.S. District Court for the Southern District of New York. These putative securities class actions are captioned: (1) Khoury v. FXCM Inc. , Case No. 1:17-cv-916; (2) Zhao v. FXCM Inc. , Case No. 1:17-cv-955; and (3) Blinn v. FXCM Inc. , Case No. 1:17-cv-1028. The complaints in these three actions allege that the defendants violated certain provisions of the federal securities laws and seek compensations.