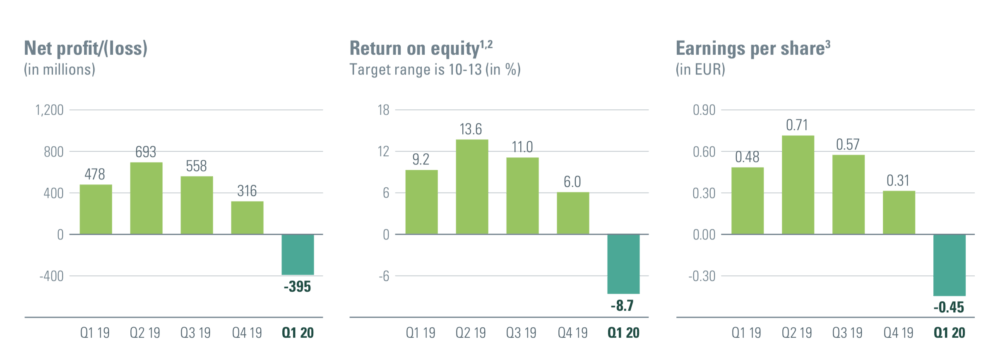

High impairment charges push ABN AMRO into loss in Q1 2020

The impairment charges growth was mainly attributable to upfront collective provisioning for sectors immediately impacted by Covid-19 and oil prices and two exceptional client files (in Clearing and the trade & commodity finance portfolio in Singapore).

ABN AMRO earlier today posted its financial report for the first quarter of 2020, with the results impacted by increased impairment charges.

The company reported a net loss of EUR 395 million due to high impairment charges. Impairment charges were EUR 1,111 million in the first quarter of 2020, versus EUR 102 million in the year-ago period. The increase of impairment charges in Q1 2020 was mainly attributable to upfront collective provisioning for sectors immediately impacted by Covid-19 and oil prices and two exceptional client files (in Clearing and the trade & commodity finance portfolio in Singapore).

Until this quarter, ABN AMRO Clearing showed a good track record in managing risk through volatile periods, recording minor impairments. However, as a result of unprecedented volumes and volatility in the financial markets following Covid-19, ABN AMRO Clearing recorded a large loss for one of its US clients. This client had a specific strategy, trading volatility as a pure asset class using US options and futures on the VIX and S&P index. Following extreme stress and dislocations in US markets, it incurred significant losses over a short timeframe and failed to meet the minimum risk and margin requirements.

To prevent further losses, ABN AMRO Clearing decided to close-out the positions of this client.

Mainly due to this loss, total impairment charges for ABN AMRO Clearing amounted to EUR 235 million in the first quarter of 2020.

In addition, the company had to record a significant impairment in Singapore due to a potential case of fraud this quarter. The client in question is active in terminals, shipping and trading, and ran into problems when oil prices fell and sales proceeds were delayed due to the economic slowdown. The company is suspected of keeping loss-making transactions outside its books. A large part of the total impairment of EUR 225 million pertained to off-balance items, such as guarantees and documentary credits.

Going back to ABN AMRO’s key financial metrics for the first quarter of 2020, let’s note that net interest income amounted to EUR 1,527 million (Q1 2019: EUR 1,573 million), mainly reflecting deposit margin pressure as the low interest rate environment continued.

Operating expenses were lower at EUR 1,300 million (Q1 2019: EUR 1,327 million), benefiting from continued cost management.

Capital position remained strong in the first quarter of 2020, with a CET1 ratio of 17.3%.