HK broker Guotai Junan registers 12% rise in profit in 2019

In 2019, total profit attributable to shareholders of Guotai Junan amounted to approximately HK$895 million, up 12.4% as compared with last year.

Hong Kong-based online trading company Guotai Junan International Hold. Limited (HKG:1788) has earlier today posted its financial results for the year to end-December 2019.

In 2019, total profit attributable to shareholders of Guotai Junan amounted to approximately HK$895 million, up 12.4% as compared with last year.

During the year under review, the Group recorded a total revenue of approximately HK$4.246 billion (2018: HK$3.026 billion), representing a significant increase of 40.3% as compared with last year, among which, the revenue of financial products, market making and investments and corporate finance maintained rapid growth, representing a year- on-year increase of 166% to approximately HK$1.734 billion and 36% to approximately HK$809 million, respectively.

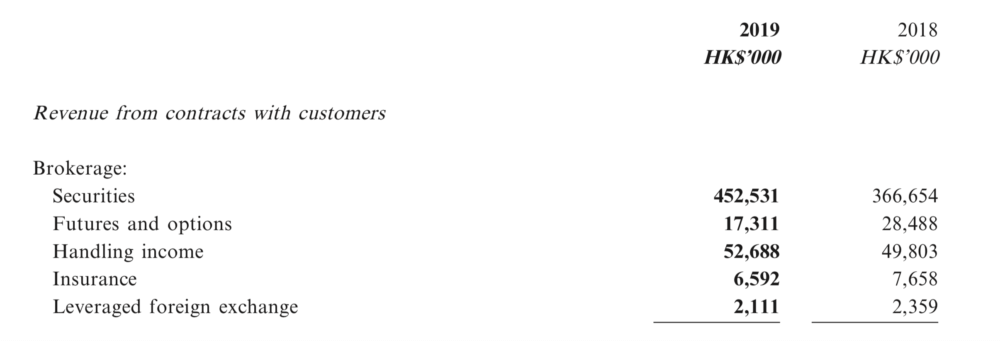

Although the average daily trading volume of the Hong Kong stock market decreased by 19% year-on-year in 2019, the Group’s brokerage business recorded a revenue of approximately HK$531 million, which is 17% higher than the HK$455 million result recorded back in 2018. Brokerage commissions from securities trading increased by approximately 23% year-on-year to HK$453 million. Revenues from leveraged FX, however, fell in annual terms.

During the year under review, the Group’s wealth management continued to attract quality clients, and the asset under management of new clients from wealth management business also increased gradually, thus driving the brokerage related trading activities.

Guotai Junan says its income structure in the financial year 2019 became more balanced, with fees and commission income accounting for 33%, interest income accounting for 36%, and investment income accounting for 31%.

As at December 31, 2019, the Group’s total assets stood at approximately HK$96.738 billion, up 10% from a year earlier, and the Group’s total liabilities were HK$85.326 billion, up 11% from the previous year. The equity attributable to holders of Shares increased by 4% to approximately HK$11.296 billion as at end-December 2019.

Regardless of the impact of COVID-19 on the market and the economy, the company said it remains confident in the economic development of the Mainland China under a continuously opening up environment in medium to long run. Guotai Junan aims to further expand and strengthen its edge and influence by its financial service platform, and enhance its wealth management services and global asset allocation capabilities, providing clients with one-stop comprehensive investment and financing solutions.

The Board recommends a final dividend of HK$0.020 per ordinary share of the company for the year to end-December 2019. Together with the interim dividend of HK$0.042 per share paid on September 19, 2019, the total dividends for the year to December 31, 2019 amount to HK$0.062 per Share (2018: HK$0.053 per Share).